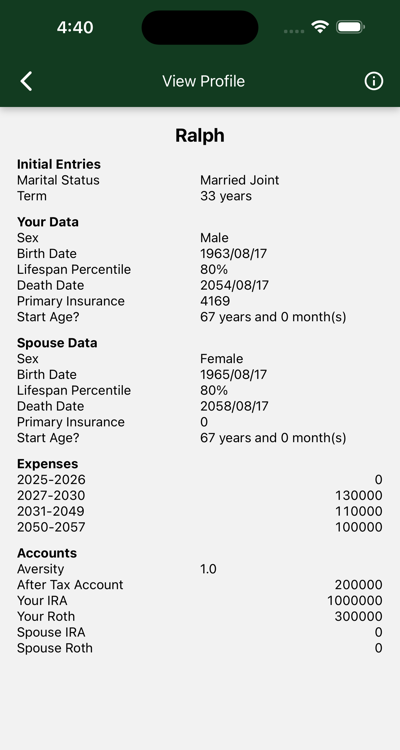

It Starts with a Profile

To create your Hedgematic portfolio, we need to collect a few facts about you, your finances, and your required expenses.

- Demographic data, e.g. Birthday, age, and sex, is used to calculate your lifespan. In this case, our couple is aged 60 and 62.

- To get the Social Security right, Hedgematic needs a number called the Primary Insurance Amount, which you get from your Social Security Statement. If you don't have it right away, Hedgematic has tools to come up with an estimate. Mom will depend on the Social Security spousal benefit.

- Hedgematic separately funds and hedges each year of your retirement. You provide the required yearly current-dollar after-tax expenses. Consider it take-home pay less taxes and retirement contributions. In this case, you wonder if you can retire in two years, so you enter zero expenses for the first two years. You spend four years paying off the mortgage, then continue your active retirement. You cut back on spending in your eighties.

- Complete data entry with balances for your after-tax, IRA, and Roth accounts. In this case, $1.5 million in three accounts.

Submit your profile and check out the results . . .

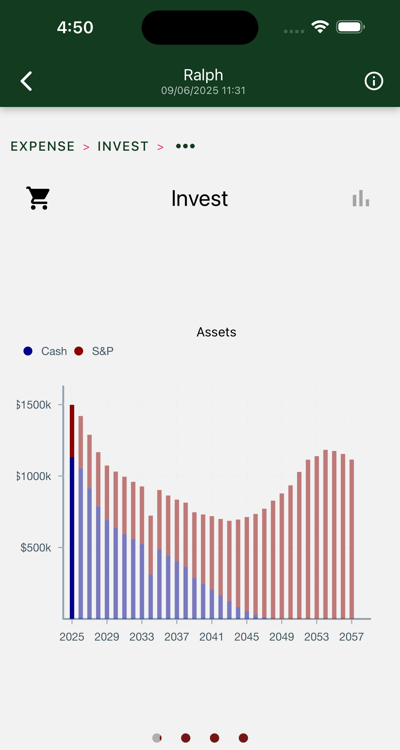

You're Covered!

Your specified yearly expenses, plus taxes, are completely covered.

Your heirs end up with a million. Not shown here, but the IRA was tapped out, so it's all tax free.

Your assets were mostly in cash (inflation protected bonds) at the start of retirement. A smaller portion was set aside in S&P investments, reserved for the later years. Compounding kicked in and you would have gone on forever, but regrettably, Ralph died and Mom's spousal benefit stopped.

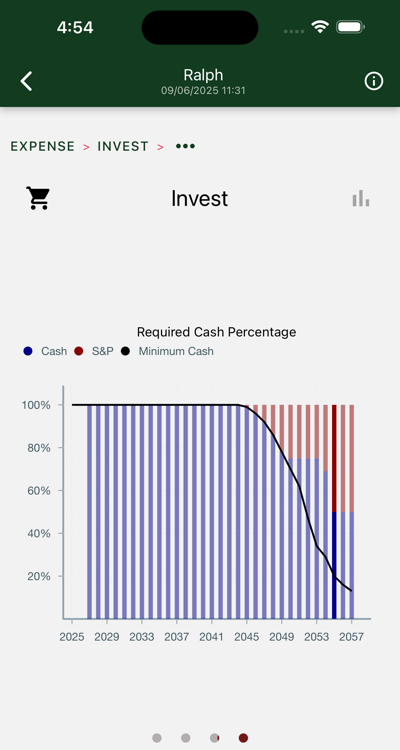

Hedged by Year

Each year's draw is split in two portions:

- For "Cash", read "inflation adjusted cash". This comes from inflation adjusted income, in this case, Social Security, and a ladder of TIPS bonds, US obligations that return constant inflation adjusted dollars plus a small real yield.

- S&P assets are lodged in an ETF that mirrors the constituents of the Standard and Poors 500 index. Historically, the S&P has returned about 6% after inflation.

Cash values are fixed and guaranteed by the US government. S&P draws are denominated in S&P index values, and so will vary year-to-year. You don't run out of money, but some years you come up short; other years, you get extra.

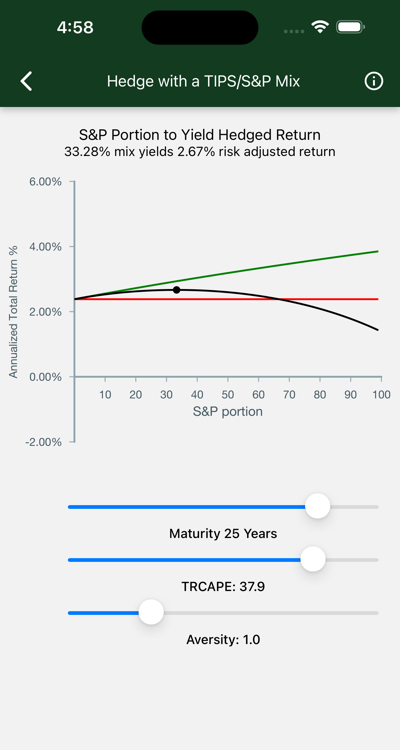

Each year is hedged separately. Anchoring the hedge, we have the TIPS real yield. A portion of S&P is added to bring up the yield to a point commensurate with your risk tolerance. These portions (shown by the black line) are determined by an open algorithm, soundly based in History and Economics.

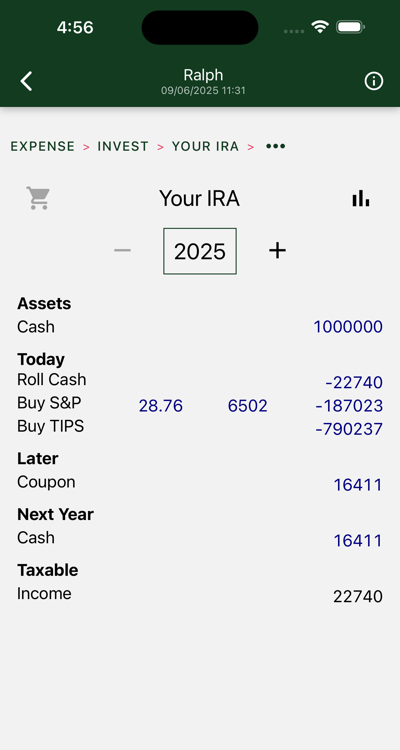

Check-in One Day Every Year

You visit your accounts one day every year. Call it "Hedgematic Day." If you are ready to get started, here are your instructions for your IRA account today.

- Start with the $1 million IRA balance.

- Roll $22740 to your Roth account.

- Buy $187023 worth of an S&P ETF.

- Buy $790237 worth of TIPS bonds. You will have to drill down to the tips bonds page (next) to get the details.

- Over the course of this year, all those bonds will be throwing off coupons for a total of $16411.

- And you'll have to pay taxes on that $22740 rollover.

Bond Ladder Essentials

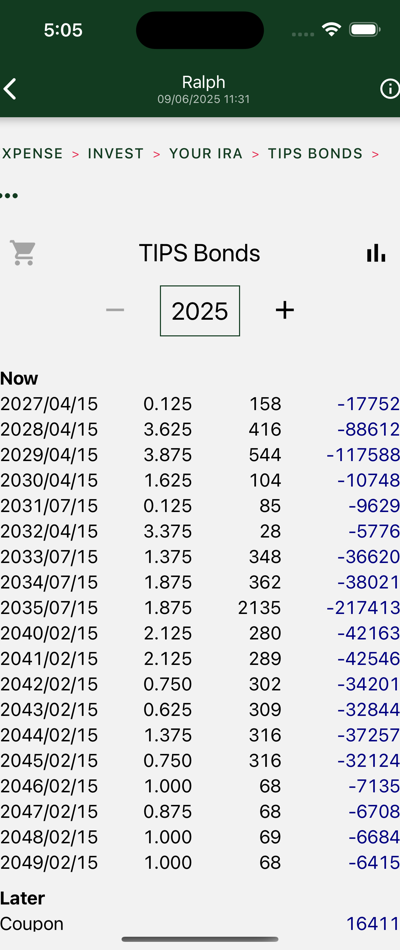

Day zero activities include setting up your TIPS bond ladder. Listed here are the purchases for your IRA account. Your job:

- Visit your broker's Treasury Bonds page. Locate the TIPS bonds.

- Each issued bond has a maturity date and a coupon rate. Find the bond that matches the first two columns.

- Buy the quantity shown in the third column. This is tricky. The amount you order is not the amount you pay.

- These bonds have a "par value" of $100. If you want 158 bonds, you order 158 times $100 or $15800 (depending on broker, likely rounded to the nearest thousand).

- For reasons, the amount you pay, estimated in the fourth column, doesn't match the order amount.

What have you done? Consider the third row. You spent $117588 to buy 544 2029/04/15 3.875 bonds. What do you get? As of September 9, 2025, you got:

- 8 coupon payments, each worth $2068 in current dollars, paid every October 15 and April 15, until April 15, 2029.

- A redemption of $106777 in current dollars on April 15, 2029.

These payments will just drop into your account, without any further attention. You have taken dollars, vulnerable to inflation, and pushed them into the future, where they will be returned to you, adjusted for intervening inflation, and with a modest real yield to boot.

Hedgematic builds the TIPS ladder to deliver each year's required cash portion, adjusted for inflation, to the moment of need.

Compare this hold to maturity approach to the traditional 60/40 bond split, where your bonds are all mixed together, and a bad year can wipe you out.

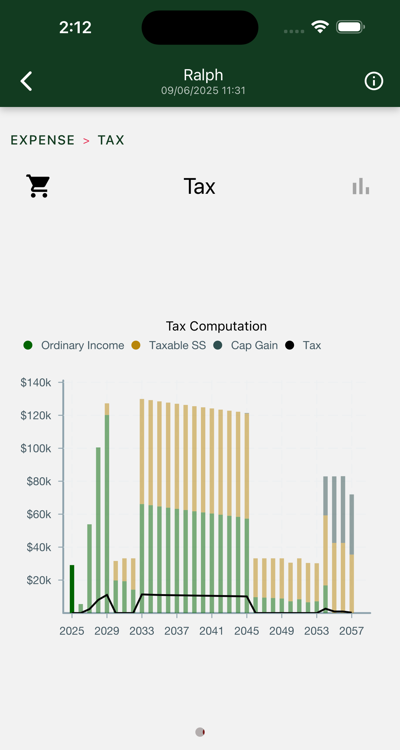

Tax Preparation Included

When you set up your Hedgematic profile, you specify spending requirements for each individual year in after-tax, inflation-adjusted dollars. Hedgematic computes your estimated taxes for each year and includes them in each year's draw. Illustrated here are the tax inputs and total federal income tax for each of these years. Notice the following:

- The black line shows the actual tax bill (in today's dollars). In this case, we never see more than about $10K in taxes, and often $0.

- Check out how the tax keeps hitting the same marks. It turns out that those marks are at the exact tax rate thresholds. Hedgematic is never going to subject you to a 20% rate if there is somewhere else in your retirement to squeeze some extra 12%.

- Notice the gently descending taxable income in the middle. Taxable Social Security is not indexed for inflation, so you get less and less income before you hit the next tax bracket.

- Hedgematic makes this possible by specifying yearly draws from after-tax, IRA, and Roth accounts, including rollovers. Compare this to "Consult your tax advisor."

Sound Fundamentals

Hedgematic includes a collection of interactive tools to help explore the concepts behind the Hedgematic Portfolio. Visiting in order, you are guided from historical background, through creation of a single hedged position, to the complete portfolio with hedged payouts for each year of retirement.

- Grounded in the work of Nobel Prize winning Economists.

- Algorithm is open and transparent. No "proprietary algorithms."

- You retain full control over your assets.

- Holdings are 100% liquid. You can respond to unanticipated events.

- No fees or loads. The difference between a half-million over 25 years at 5% and 6% is $453K.

The Hedgematic Portfolio is your starting point for any retirement plan discussion.