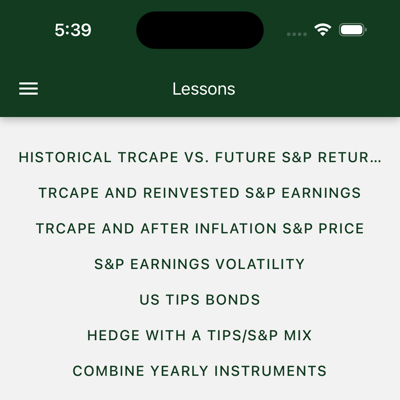

TRCAPE vs. Future S&P Returns

Is past performance any guide to future stock market returns?

Hedgematic includes a collection of interactive tools to help explore the concepts behind the Hedgematic Portfolio. Visiting in order, you are guided from historical background, through creation of a single hedged position, to the complete portfolio with hedged payouts for each year of retirement.

Is past performance any guide to future stock market returns?

What does past data suggest about the relationship between TRCAPE and expected future S&P returns?

What does past data suggest about the relationship between TRCAPE and expected future inflation-adjusted S&P prices?

The stock market offers attractive average and long-term returns. But what about volatility?

TIPS (Treasury Inflation Protected Securities) Bonds promise inflation-protected yields, guaranteed by the US government.

For a given maturity, vary the proportion of S&P and TIPS holdings to achieve desired risk/return.

Hedge your retirement with individual yearly hedged portfolios.