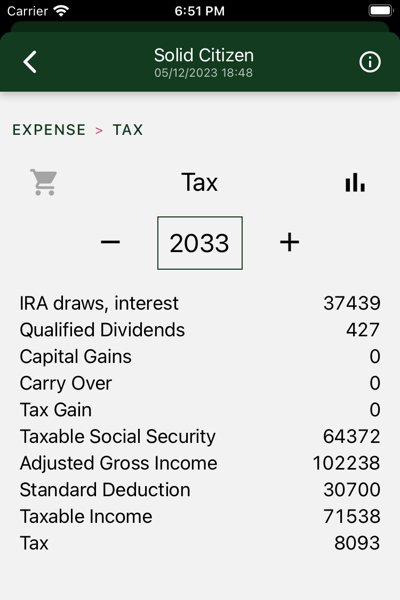

Hedgematic computes optimized tax returns for each year of your retirement. Displayed here is your estimated tax return.

Charts

One chart is displayed.

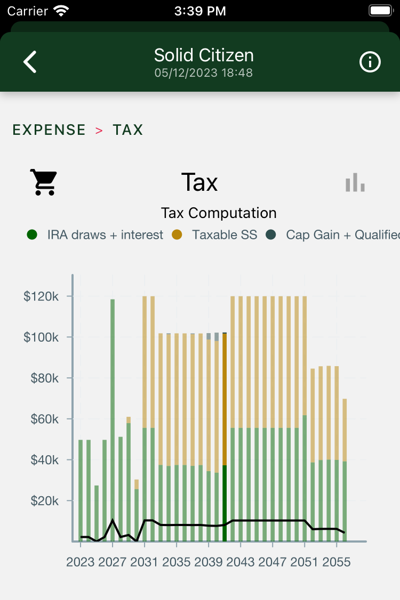

Tax Computation

Bars represent entries on your 1040.

- Ordinary income includes interest on bonds and withdrawals from your IRA.

- Taxable Social Security is that portion of Social Security subject to income taxes.

- Qualified Dividends and Capital Gains include reinvested S&P dividends and gains or losses on S&P sales.

The line at the bottom displays your total tax liability.

Notice the following:

- In this case, with $1.5 million in initial assets and yearly withdrawals of $110K we never see more than about $10K in taxes, and sometimes $0.

- Year after year we see constant values for adjusted gross income. As it turns our, AGI is usually pegged to IRS tax rate thresholds. This is a consequence of Hedgematic’s tax optimization strategy.

- When you drill down to your IRA and Roth accounts, you will see how rollovers are used to source each yearly withdraw from the best combination of taxed and tax-free accounts.