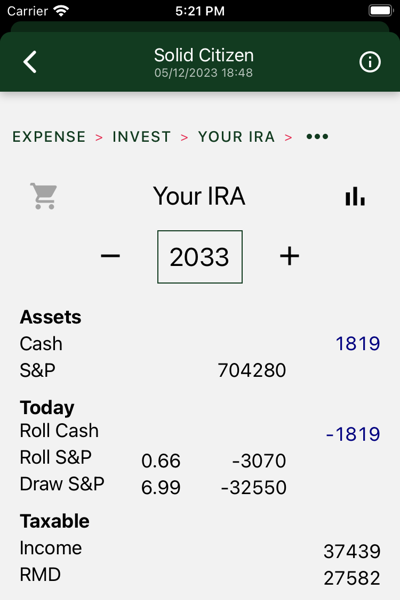

This is one of your IRA accounts.

After the asset summary, required actions are shown for each year. Drill down to see details. Here we have the required transactions some years after portfolio creation. You might see:

- Cash draws

- S&P draws

- Cash rollovers to Roth

- S&P rollovers to Roth

At the bottom, taxable income created by withdrawals is listed, along with the RMD, if applicable.

Charts

Three charts are shown. Swipe to view each in turn.

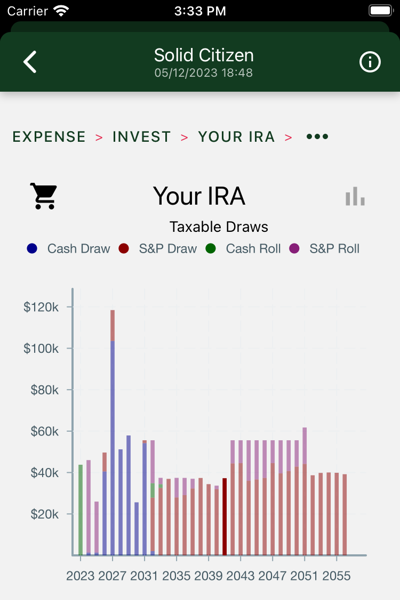

Taxable Draws

Withdrawals from your IRA account. These numbers are taxed as ordinary income. There are two ways to draw from an IRA:

- A regular distribution is included in your expenses for the year.

- IRA assets can also be “rolled over” to your Roth account. Pay your taxes on the withdrawal when you roll over, and later withdraw them tax-free from the Roth account. Hedgematic uses this strategy to smooth your tax rates over the entire course of your retirement.

If applicable, required minimum distributions (RMDs) are taken.

Withdrawals and rollovers from cash and S&P are shown separately.

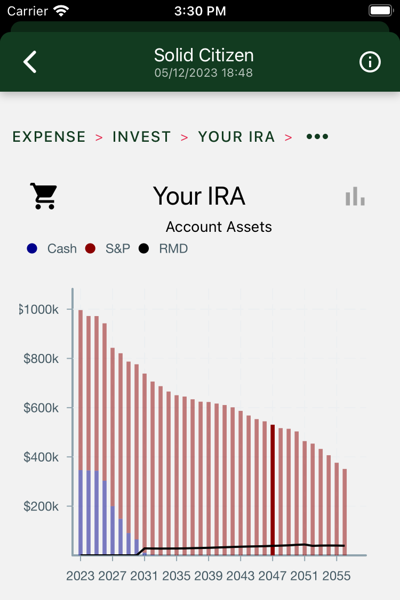

Account Assets

Yearly total account balances, with cash and S&P assets highlighted. The black line shows your required minimum distribution, or RMD.

Here we see we took our cash and bought some bonds and S&P. The bonds are exhausted in a few years. The total balance trends down under pressure from yearly draws and the occasional tax-smoothing Roth roll-over.

Untaxed Earnings

These numbers are for information only and not entered on your tax return.

We can see:

- Bond coupons in the first couple years.

- S&P dividends over remaining years.

- Capital gains and decreasing dividends as S&P portion is liquidated.