TIPS Bond

Individual TIPS Inflation Protected Bonds

Hedgematic uses TIPS to to hold the inflation/market risk protected portion of your portfolio.

Bonds are purchased on day zero and held to maturity. They are not subject to interest rate volatility, unlike bond funds where they are all mashed together.

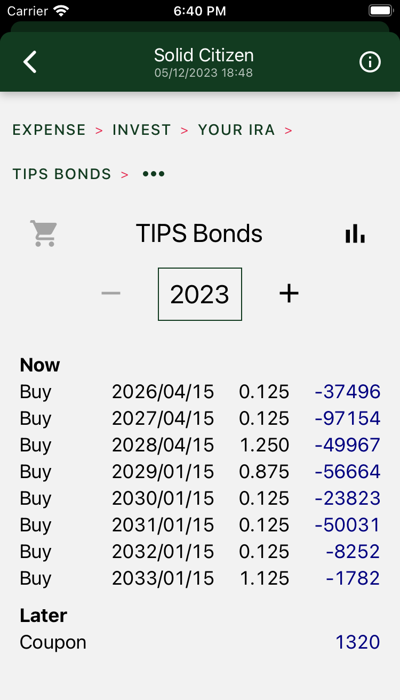

Displayed above is your day zero TIPS shopping list for your IRA account. You see a ladder of bonds, each of which are redeemed in separate years to give you the guaranteed portion of your yearly expenses. Note that as the term increases, the values decrease. In the out years we can rely more on the typically more profitable S&P to provide more income.

Your broker will list these bonds with treasury bills. Use the “Cusip” id to identify the specific bond. Bond prices vary throughout the day, and Hedgematic does not update them constantly.

Bonds will pay coupons twice a year. In after-tax accounts, coupons and an inflation adjustment are reported as income.

Bond income and redemptions are drawn from the account at the end of the year and applied to next year’s expenses.

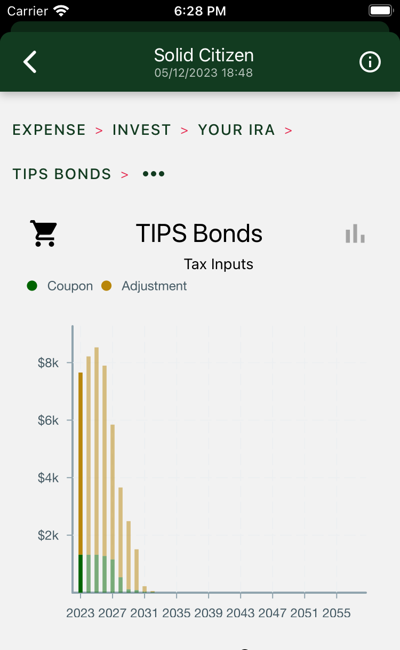

Figures shown in following years are denominated in today’s dollars, and can be relied on with one exception; the inflation adjustment shown is only an estimate and has an effect only in after-tax accounts.

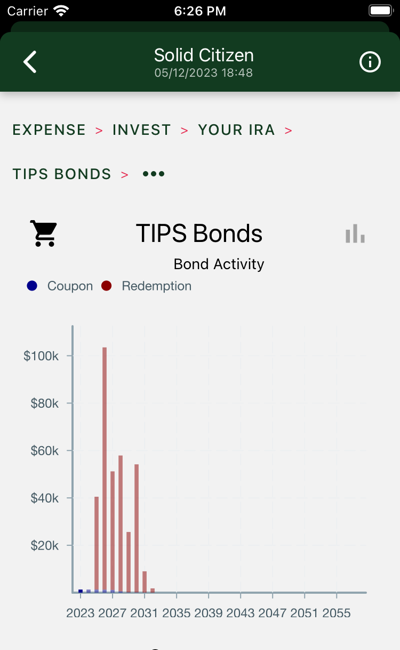

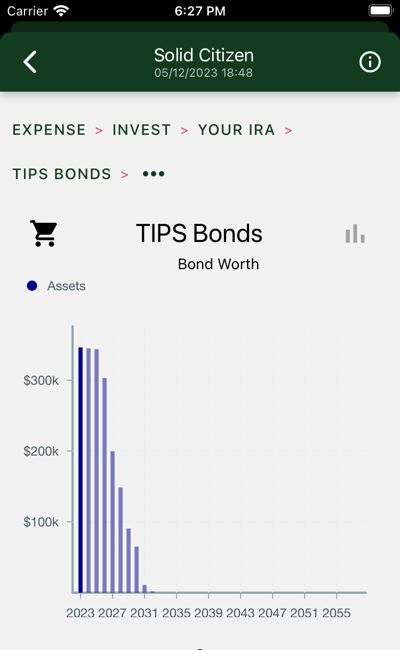

Three charts are shown. Swipe to view each in turn.

Tall bars are redemptions. Tiny bars are coupons.

Total bond value decreases as earlier maturities are redeemed.

If we are in an after-tax account, these figures show up on your tax return. Otherwise, they document tax-free accumulations.

Individual TIPS Inflation Protected Bonds