This is the multi-page printable view of this section.

Click here to print.

Return to the regular view of this page.

Asset Classess

Account balances are allocated three ways

Your after-tax, IRA, and Roth accounts each contain a mix of the following:

- S&P ETF

- TIPS Inflation Protected Bonds

- Cash

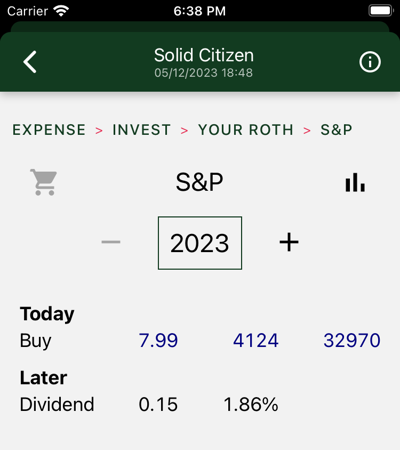

When you are ready to commit to a particular portfolio computation, you find your shopping list for year 0 under each account, with a page for each asset type.

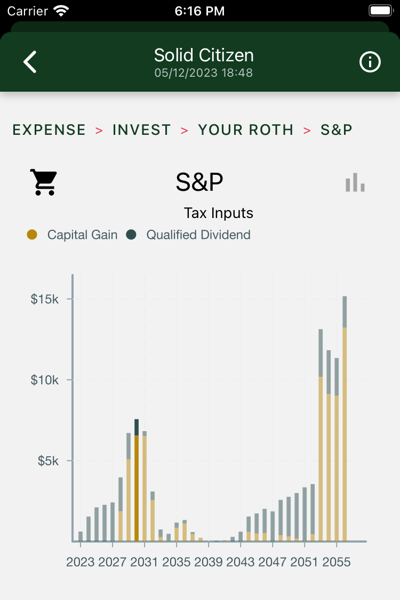

1 - S&P

S&P ETF

The S&P 500 is the oldest, most studied index of stock market performance. Hedgematic uses an S&P ETF to capture stock market income and gains. Your brokerage account and any retirement accounts each may have S&P holdings.

Hedgematic tracks S&P holdings in “S&P units”. Each unit is valued at the current S&P average. Your ETF will be priced differently. When you are directed to buy or sell so many units, multiply by the current S&P and divide by the current ETF to get the number of ETF shares to transact.

On day 0, inflation adjusted values and actual dollars are the same. In the first year, as displayed here, you have deployed all Roth assets to S&P.

Following the initial purchase, you are not directed to make any additional purchases, with the exception of reinvested dividends. (there are also in-kind rollovers). In effect, your S&P assets are split into individual tranches, each targeted at a particular year and “held to maturity.”

Hedgematic specifies S&P unit withdrawals for each year. You could just uninstall the app and follow the plan, withdrawing your yearly sums. More likely, you will look to rebalance each year.

The dollar figures shown in future years are estimates denominated in today’s dollars, so you should not expect them to match your future sale proceeds. Your proceeds, if you do back out future inflation, may come out higher or lower than the today’s dollar figures shown, which are merely predictions.

There is a chance that these proceeds may not meet your specified after-inflation expenses. You indicated your tolerance for this outcome with the risk aversity you included when you created your profile. But there will be a payday every year. Barring catastrophe, you will not run out of money.

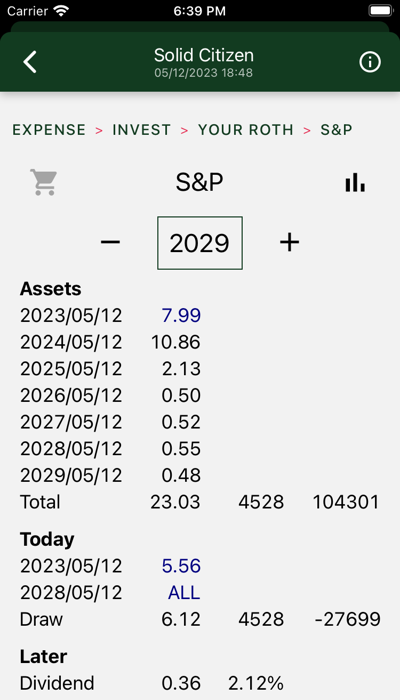

Above is an out-year display.

At the top of the screen, you see you are holding multiple lots of S&P. In this case, we are looking at a Roth account, so each lot may have included a mix of reinvested and rolled-in shares.

At the bottom of the illustrated screen, you are instructed to sell part of one lot of your holdings and the entirety of another.

Sale proceeds wind up in cash where they are drawn to support your year’s expenses.

Charts

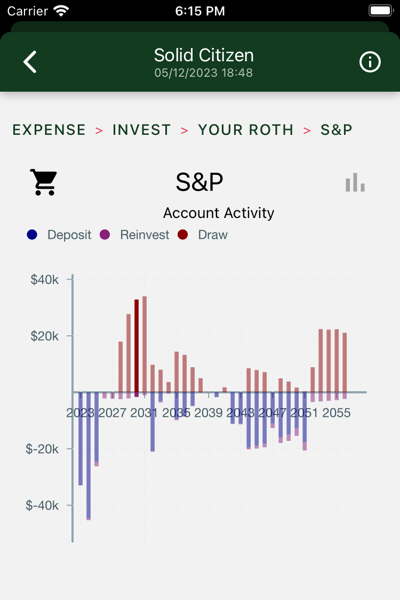

Three charts are shown. Swipe to view each in turn.

Account Activity

Withdrawals are on top. Initial purchases, reinvestments, and roll-ins are on the bottom.

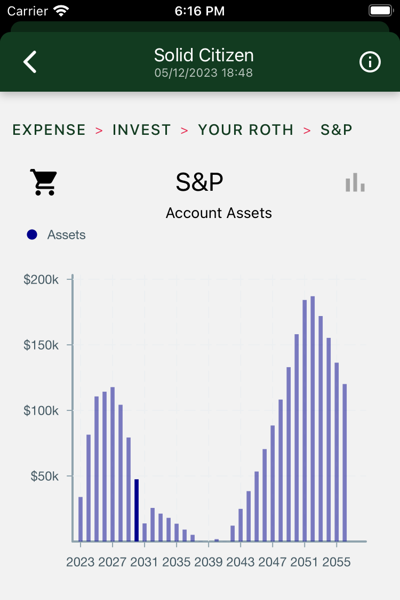

Account Assets

Yearly total account balances.

If we are in an after-tax account, these figures show up on your tax return. Otherwise, they are tax-free accumulations.

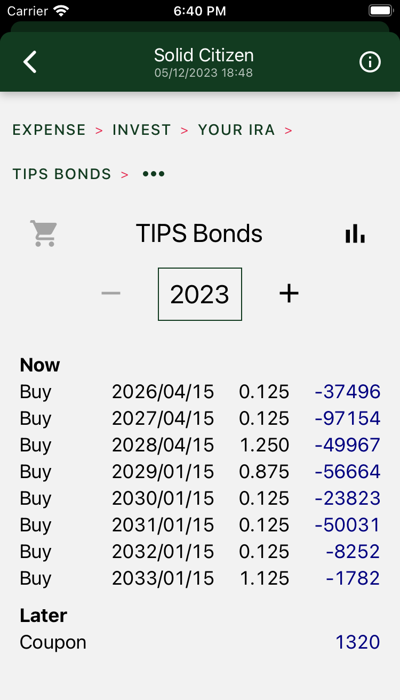

2 - TIPS Bonds

TIPS Inflation Protected Bonds

Hedgematic uses TIPS to to hold the inflation/market risk protected portion of your portfolio.

Bonds are purchased on day zero and held to maturity. They are not subject to interest rate volatility, unlike bond funds where they are all mashed together.

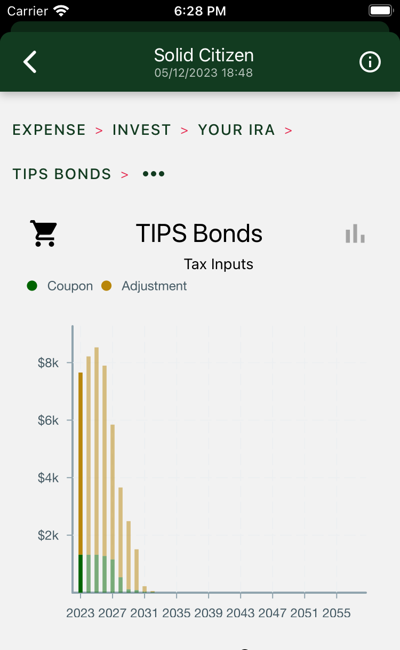

Displayed above is your day zero TIPS shopping list for your IRA account. You see a ladder of bonds,

each of which are redeemed in separate years to give you the guaranteed portion of your yearly expenses. Note that as the term increases, the values decrease. In the out years we can rely more on the typically more profitable S&P to provide more income.

Your broker will list these bonds with treasury bills. Use the “Cusip” id to identify the specific bond. Bond prices vary throughout the day, and Hedgematic does not update them constantly.

Bonds will pay coupons twice a year. In after-tax accounts, coupons and an inflation adjustment are reported as income.

Bond income and redemptions are drawn from the account at the end of the year and applied to next year’s expenses.

Figures shown in following years are denominated in today’s dollars, and can be relied on with one exception; the inflation adjustment shown is only an estimate and has an effect only in after-tax accounts.

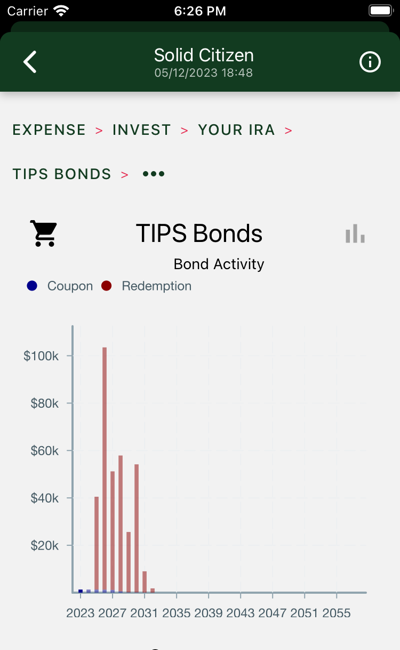

Charts

Three charts are shown. Swipe to view each in turn.

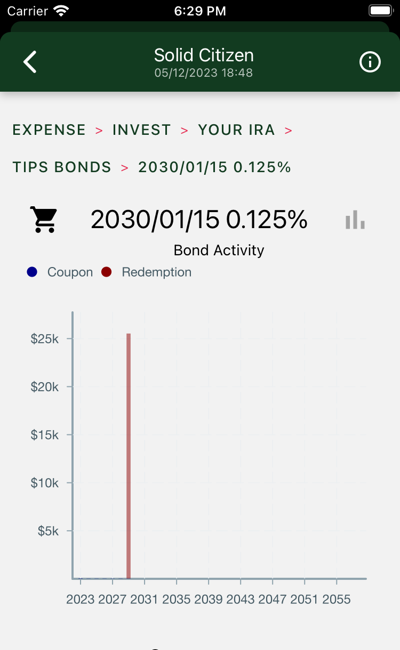

Bond Activity

Tall bars are redemptions. Tiny bars are coupons.

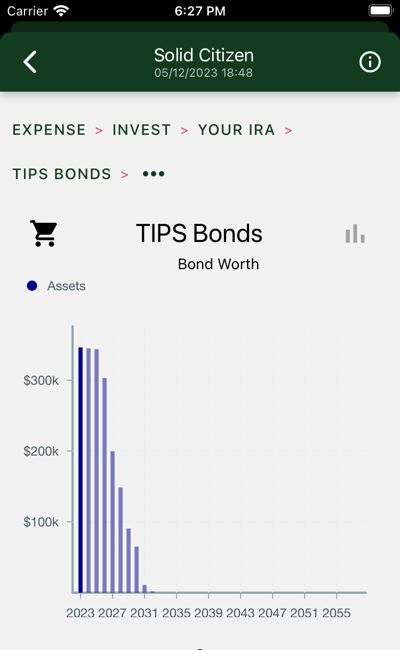

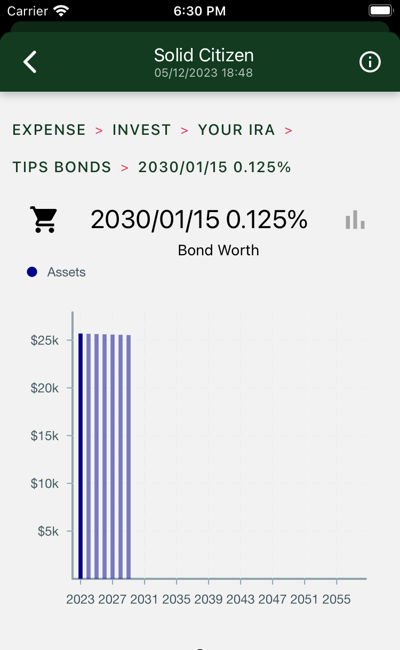

Bond Assets

Total bond value decreases as earlier maturities are redeemed.

If we are in an after-tax account, these figures show up on your tax return. Otherwise, they document tax-free accumulations.

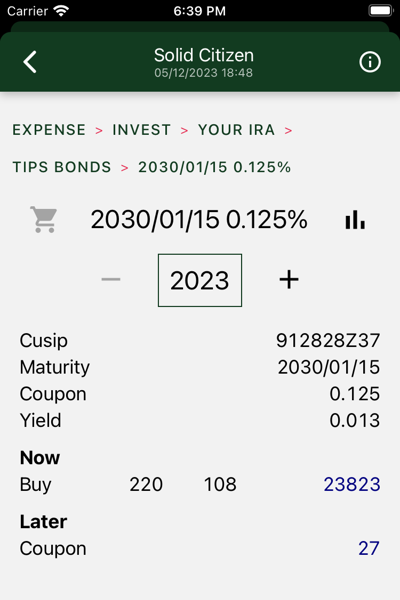

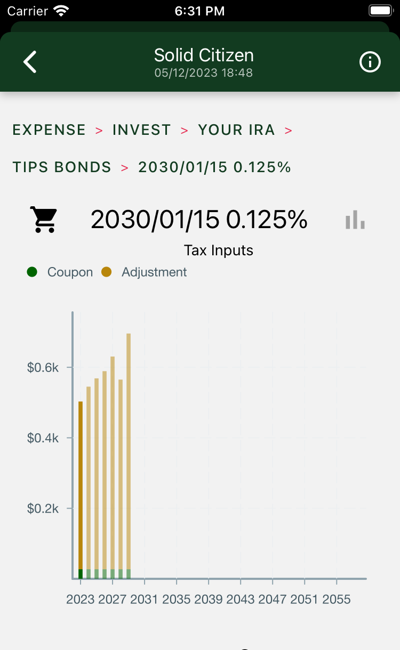

2.1 - TIPS Bond

Individual TIPS Inflation Protected Bonds

Display includes the Cusip id for identifying this individual bond issue, as well as disaggregating figures that appear as totals on the parent bond list display.

Charts

Three charts are shown. Swipe to view each in turn.

Bond Activity

See tiny coupons followed by big redemption.

Bond Assets

Present value of bond declines as coupons are paid out.

The coupons are in today’s dollars. Your adjustments will vary.