This is the multi-page printable view of this section.

Click here to print.

Return to the regular view of this page.

Your Hedgmatic Results

Interpreting your Hedgematic results

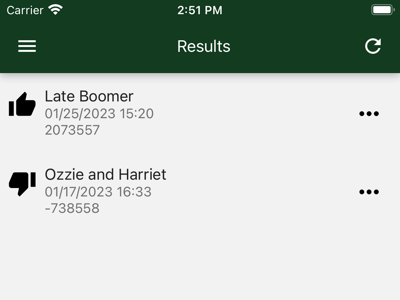

Every time you compute results for one of your profiles a row is added to this list.

Each entry includes the name of the profile, the date it was computed, and the over/short dollars.

Thumbs up means all your expenses are covered; the dollar figure is your estate.

Thumbs down means you have to add money or reduce expectations before commencing your life of leisure.

Tap the row to display the results of one computation.

The dot menu allows you to delete the result (leaving the profile untouched).

1 - Expenses

Commence result navigation with Expenses

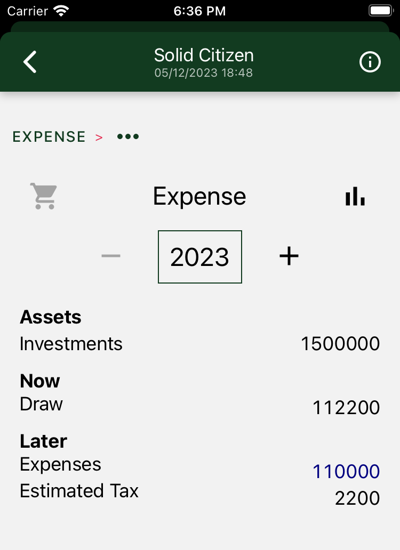

This is the first result screen you will see. Did you make your expenses. Are you over? Where are you short?

This, and succeeding screens, share navigation features.

- At each level, you can select the cart view or the chart view. Illustrated is the cart view. The cart view is where you find listed the actions you take today and on succeeding yearly anniverseries, as well as asset summaries and anticipated transactions over the course of the remainder of the year.

- Get the numbers for each year by changing the year.

The breadcrumb at the top of the page lets you drill down on result details and pop back up.

Tap the dots to select drill-down options. Here we have Investment, Tax, and Social.

The back arrow returns you to the result list. Return to the top level by tapping EXPENSE in the breadcrumb.

Charts

Tap the chart icon to see charts for each level.

Usually, multiple charts are available. Swipe to view each in turn.

Tap inside the chart to change the cart view display year.

Tap the cart view icon to switch back to cart view.

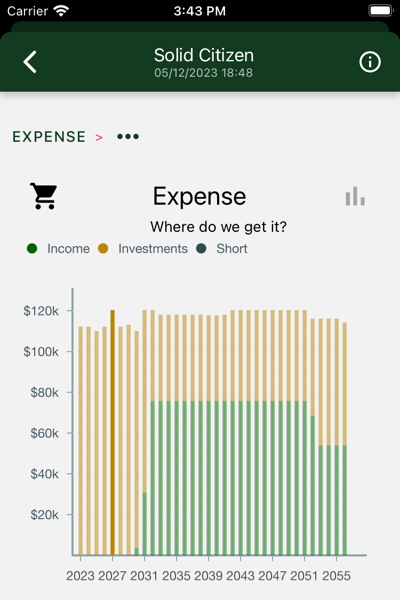

At this level three charts are available.

Where do we get it?

Data is displayed for the duration of your retirement. In this case we see retirement can start immediately.

Bars represent the actual income from investments or cash income and any shortfall between that income and your required expenses. Cover the shortfalls and you are ready to commence retirement.

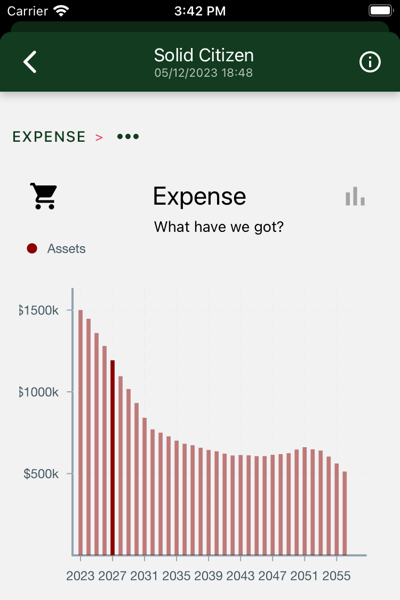

What have we got?

Shows total balance over years in your investment accounts. In this case we see assets diminishing until Social Security kicks in. After many comfortable years, Mr. Solid Citizen dies, and the Mrs., on reduced payments, starts to draw down the balance, eventually leaving half a million to her heirs.

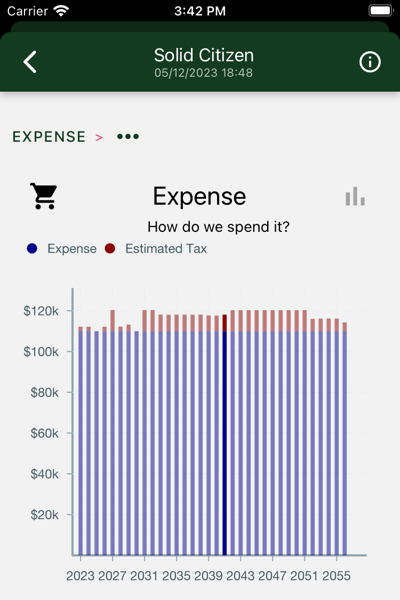

How do we spend it?

Your expenses are your desired inflation-adjusted, after-tax expenses, plus estimated taxes you need to pay.

1.1 - Investments

Drill down on investments

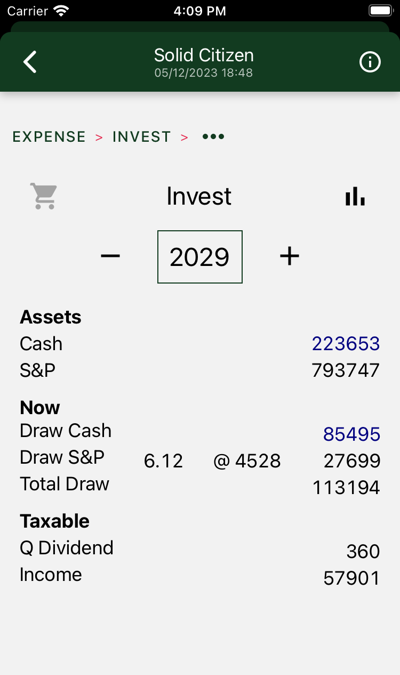

Your assets are divided between after-tax and retirement accounts. Within each account, assets may be held in “cash,” including inflation-protected bonds, or S&P index instruments.

In this year, we draw cash and S&P. Cash draws are denominated in today’s dollars. The S&P withdrawal is denominated in S&P units, or multiples of the S&P average. The dollar figure is an estimate and will vary depending on market performance. Some years you get more, some less.

The draw includes after-tax expenses and estimated tax payment.

Figures at the bottom show tax imputs from your investments.

Charts

Four charts are shown. Swipe to view each in turn.

Drill down further in results to see similar charts for each separate account. Charts on this page show totals across all of your accounts.

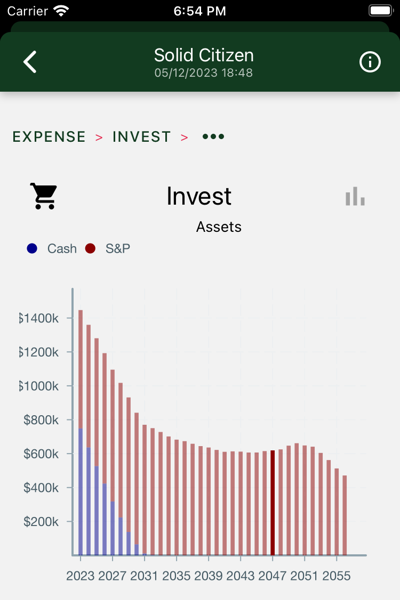

Assets

Yearly total account balances, with “cash” and S&P assets highlighted. Cash assets are reserved for the early years, when stock market volatility poses the greatest risk and you don’t have social security to anchor your hedge.

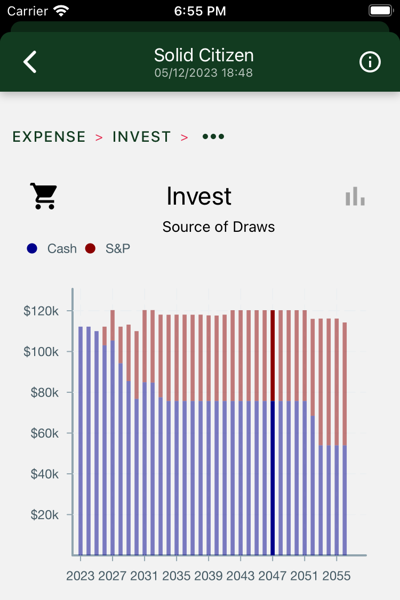

Source of draws

Withdrawals from your investment accounts. Cash assets are consumed first, until the higher expected returns of the stock market catch up to and overtake their expected risk.

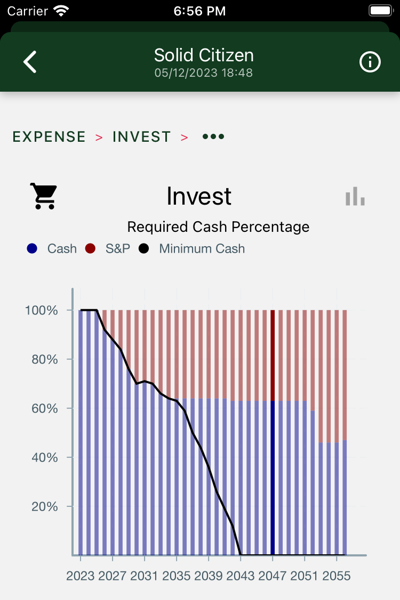

Required cash percentage

The bars show the percentage of cash assets in each year’s draw. The line shows the required percentage. The bars and line diverge when social security starts, giving you enough cash income to cover your hedge.

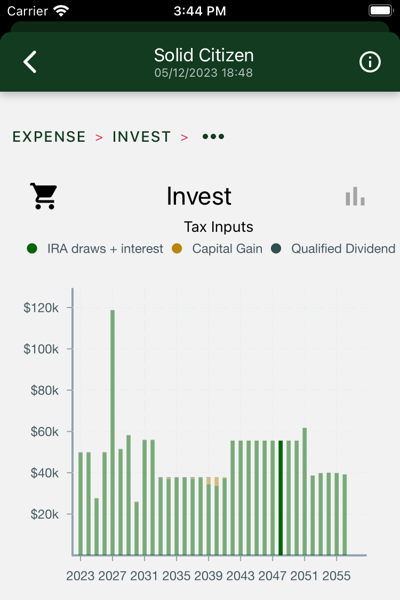

These numbers are entered on your tax return. They come from two sources:

- After tax account:

- Ordinary income from bond interest.

- Imputed ordinary income from bond inflation adjustments

- Qualified dividends from S&P ETFs. These are reinvested.

- Capital gain or loss on S&P draws.

- Traditional IRAs

- Withdrawals are taxed as ordinary income.

- Rollovers to Roth accounts are also treated as ordinary income.

In this case, IRA draws are the biggest contributor.

1.1.1 - Broker

After-tax account

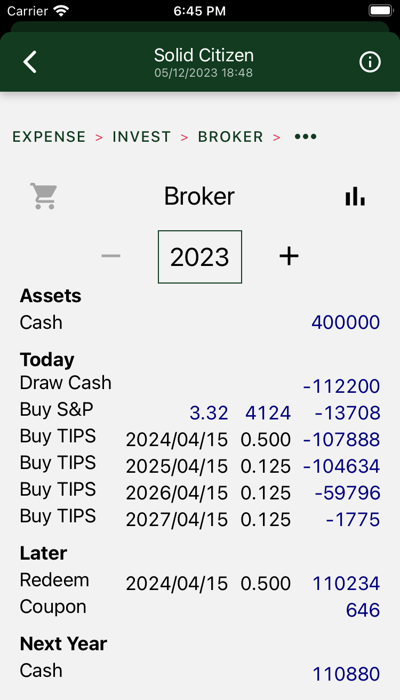

This is your “broker” or after-tax account.

Required actions are shown for each year. Drill down to see details. The illustration shows the transactions used to set up the portfolio in the first year, in this case, an S&P purchase, and a ladder of TIPS bonds that mature over the first years of the portfolio.

Bond and social security income accrues over the remainder of the year. It is carried over to the next year, where it is typically pulled with the cash draw. (On those occasions where it is not, inflation is charged.)

Charts

Three charts are shown. Swipe to view each in turn.

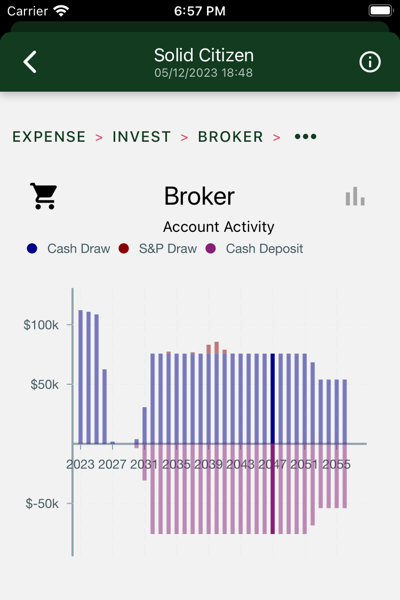

Account Activity

In this chart, we see an initial set of withdrawals used to support us for the first three years. On the right side of the chart we mostly see social security deposits being deposited, then withdrawn to support the succeeding year.

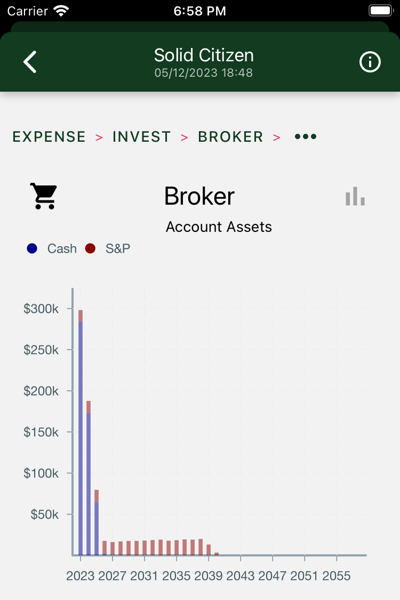

Account Assets

Yearly total account balances, with “cash” and S&P assets highlighted.

Here we see we took our cash and bought some bonds and S&P. The bonds are gone pretty quick. The stock lasts a little longer, but in the remaining years, the account serves only to accumulate income until the start of the next year, when it is flushed.

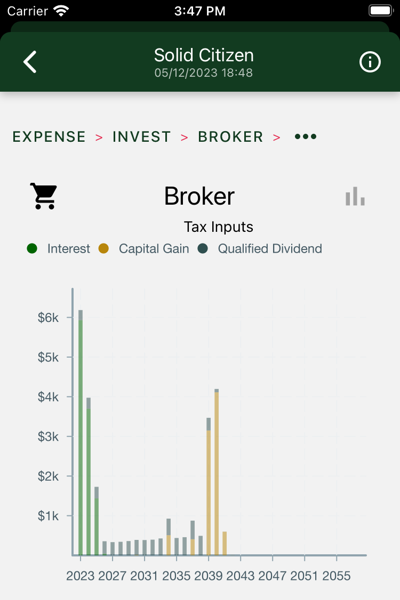

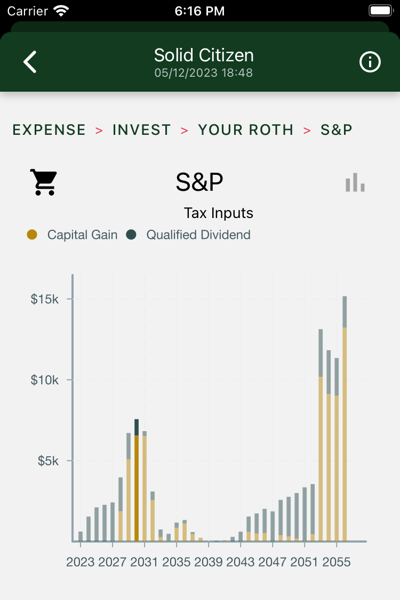

These numbers are entered on your tax return.

We can see:

- Bond coupons in the first couple years.

- S&P dividends over remaining years.

- Capital gains as S&P portion is liquidated.

1.1.2 - IRA

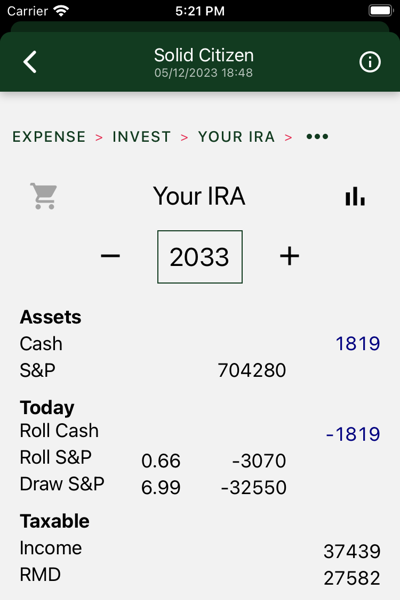

IRA balances and transactions

This is one of your IRA accounts.

After the asset summary, required actions are shown for each year. Drill down to see details. Here we have the required transactions some years after portfolio creation. You might see:

- Cash draws

- S&P draws

- Cash rollovers to Roth

- S&P rollovers to Roth

At the bottom, taxable income created by withdrawals is listed, along with the RMD, if applicable.

Charts

Three charts are shown. Swipe to view each in turn.

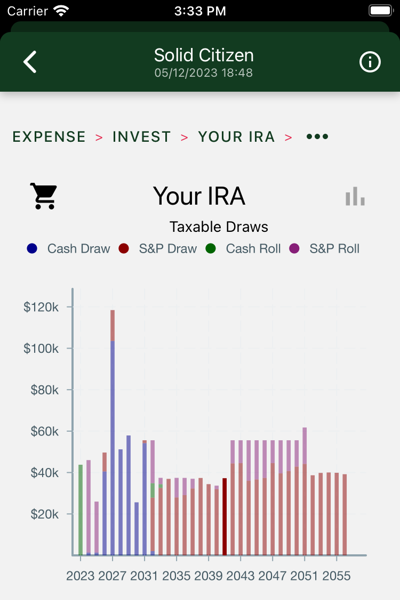

Taxable Draws

Withdrawals from your IRA account. These numbers are taxed as ordinary income. There are two ways to draw from an IRA:

- A regular distribution is included in your expenses for the year.

- IRA assets can also be “rolled over” to your Roth account. Pay your taxes on the withdrawal when you roll over, and later withdraw them tax-free from the Roth account. Hedgematic uses this strategy to smooth your tax rates over the entire course of your retirement.

If applicable, required minimum distributions (RMDs) are taken.

Withdrawals and rollovers from cash and S&P are shown separately.

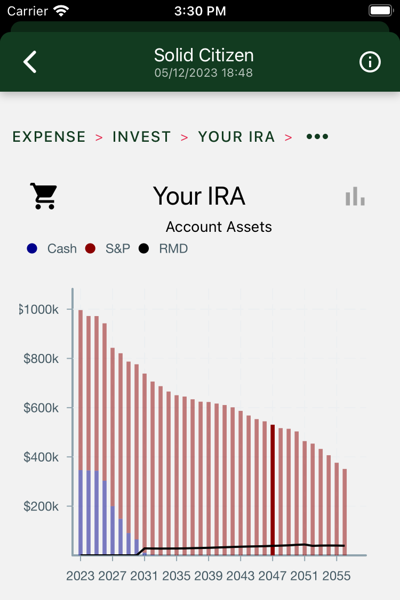

Account Assets

Yearly total account balances, with cash and S&P assets highlighted. The black line shows your required minimum distribution, or RMD.

Here we see we took our cash and bought some bonds and S&P. The bonds are exhausted in a few years. The total balance trends down under pressure from yearly draws and the occasional tax-smoothing Roth roll-over.

Untaxed Earnings

These numbers are for information only and not entered on your tax return.

We can see:

- Bond coupons in the first couple years.

- S&P dividends over remaining years.

- Capital gains and decreasing dividends as S&P portion is liquidated.

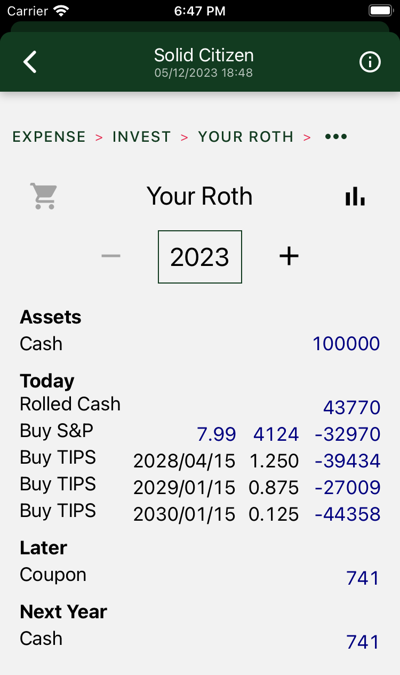

1.1.3 - Roth

Roth account balances and transactions

This is one of your Roth accounts.

Shown are first year transactions. In this case, we take a rollover from the IRA, then make an S&P purchase, and a ladder of TIPS bonds that mature over the first years of the portfolio.

Charts

Three charts are shown. Swipe to view each in turn.

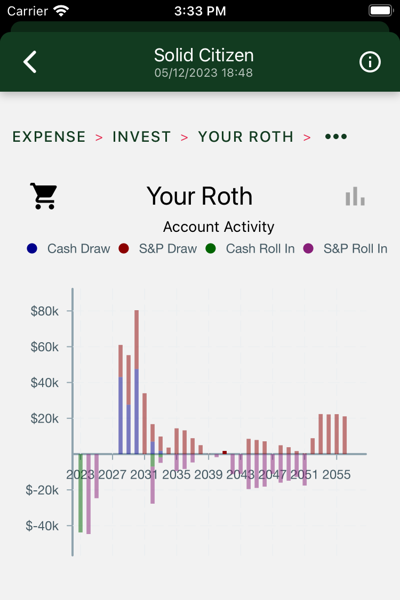

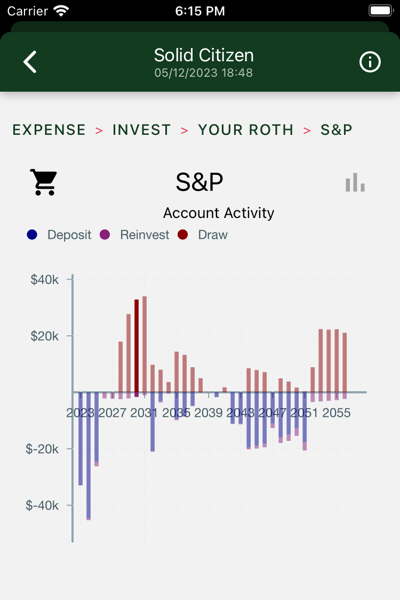

Account Activity

Withdrawals are on top. Roll-ins are on the bottom.

Withdrawals and roll-ins from “cash” and S&P accounts are shown separately.

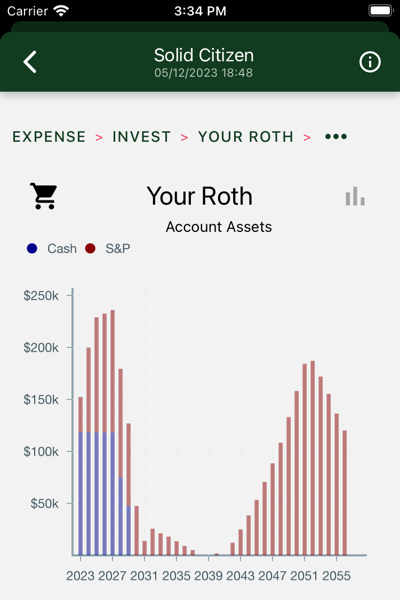

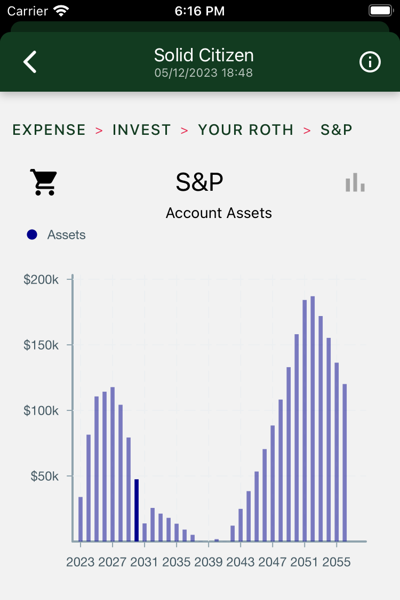

Account Assets

Yearly total account balances, with “cash” and S&P assets highlighted.

In this case, the bulk of the estate migrates to the Roth account as RMDs are just pitched into the Roth account.

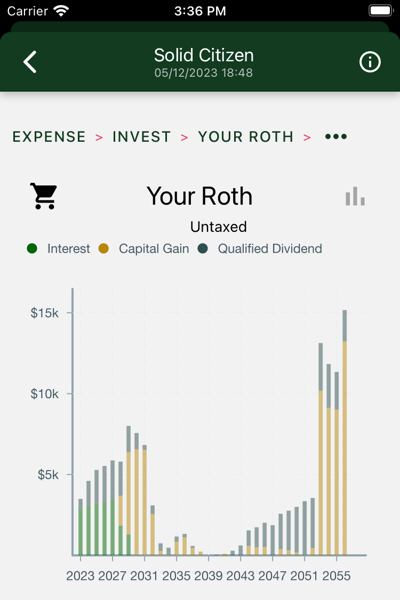

Untaxed Earnings

These numbers are shown solely for amusement purposes.

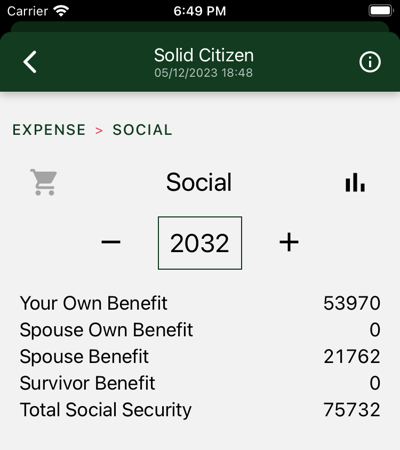

1.2 - Social Security

Review Social Security income

Total Social Security payments include:

- Your Social Security benefit.

- Your spouse’s Social Security benefit.

- Spouse benefit, if available.

- Survivor benefit, if available.

Social Security is computed from personal data in your profile. If you specified “Optimize Social Security,” the start ages shown here are optimized

for maximum total benefit. If you did not so specify, or are already receiving Social Security, the start ages you provided are used.

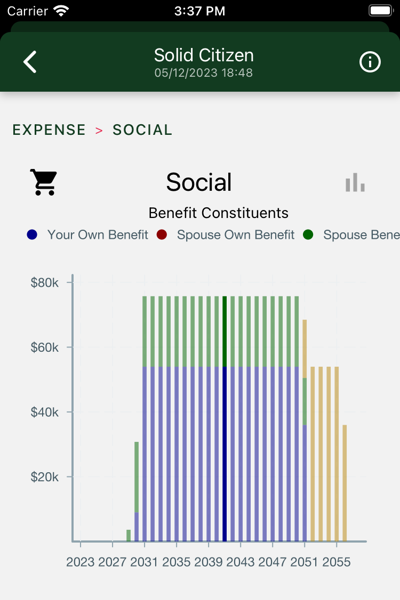

Charts

One chart is shown.

Note that Mrs. Citizen starts taking her spouse benefit before the Mister turns 70 and commences taking his. After his death, she subsists on her survivor benefit.

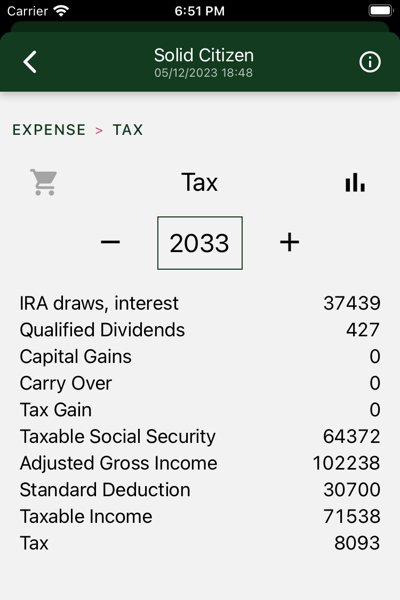

1.3 - Taxes

Optimized inflation-adjusted income taxes

Hedgematic computes optimized tax returns for each year of your retirement. Displayed here is your estimated tax return.

Charts

One chart is displayed.

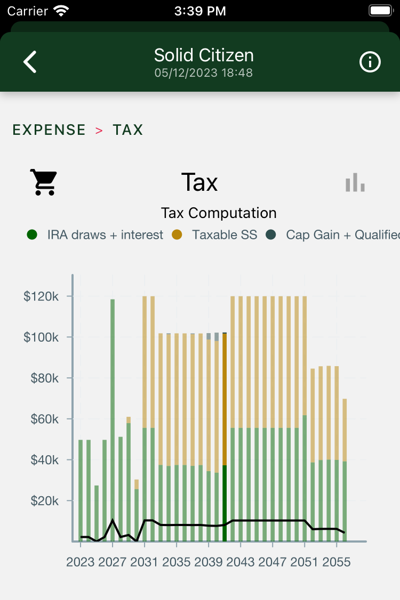

Tax Computation

Bars represent entries on your 1040.

- Ordinary income includes interest on bonds and withdrawals from your IRA.

- Taxable Social Security is that portion of Social Security subject to income taxes.

- Qualified Dividends and Capital Gains include reinvested S&P dividends and gains or losses on S&P sales.

The line at the bottom displays your total tax liability.

Notice the following:

- In this case, with $1.5 million in initial assets and yearly withdrawals of $110K we never see more than about $10K in taxes, and sometimes $0.

- Year after year we see constant values for adjusted gross income. As it turns our, AGI is usually pegged to IRS tax rate thresholds. This is a consequence of Hedgematic’s tax optimization strategy.

- When you drill down to your IRA and Roth accounts, you will see how rollovers are used to source each yearly withdraw from the best combination of taxed and tax-free accounts.

2 - Asset Classess

Account balances are allocated three ways

Your after-tax, IRA, and Roth accounts each contain a mix of the following:

- S&P ETF

- TIPS Inflation Protected Bonds

- Cash

When you are ready to commit to a particular portfolio computation, you find your shopping list for year 0 under each account, with a page for each asset type.

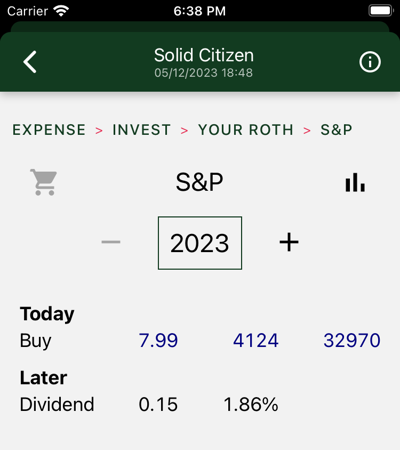

2.1 - S&P

S&P ETF

The S&P 500 is the oldest, most studied index of stock market performance. Hedgematic uses an S&P ETF to capture stock market income and gains. Your brokerage account and any retirement accounts each may have S&P holdings.

Hedgematic tracks S&P holdings in “S&P units”. Each unit is valued at the current S&P average. Your ETF will be priced differently. When you are directed to buy or sell so many units, multiply by the current S&P and divide by the current ETF to get the number of ETF shares to transact.

On day 0, inflation adjusted values and actual dollars are the same. In the first year, as displayed here, you have deployed all Roth assets to S&P.

Following the initial purchase, you are not directed to make any additional purchases, with the exception of reinvested dividends. (there are also in-kind rollovers). In effect, your S&P assets are split into individual tranches, each targeted at a particular year and “held to maturity.”

Hedgematic specifies S&P unit withdrawals for each year. You could just uninstall the app and follow the plan, withdrawing your yearly sums. More likely, you will look to rebalance each year.

The dollar figures shown in future years are estimates denominated in today’s dollars, so you should not expect them to match your future sale proceeds. Your proceeds, if you do back out future inflation, may come out higher or lower than the today’s dollar figures shown, which are merely predictions.

There is a chance that these proceeds may not meet your specified after-inflation expenses. You indicated your tolerance for this outcome with the risk aversity you included when you created your profile. But there will be a payday every year. Barring catastrophe, you will not run out of money.

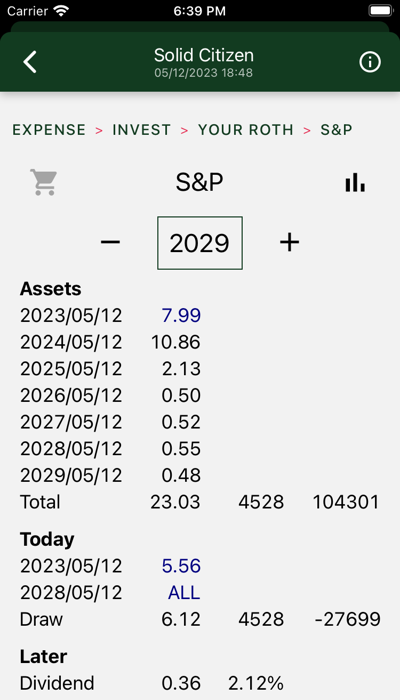

Above is an out-year display.

At the top of the screen, you see you are holding multiple lots of S&P. In this case, we are looking at a Roth account, so each lot may have included a mix of reinvested and rolled-in shares.

At the bottom of the illustrated screen, you are instructed to sell part of one lot of your holdings and the entirety of another.

Sale proceeds wind up in cash where they are drawn to support your year’s expenses.

Charts

Three charts are shown. Swipe to view each in turn.

Account Activity

Withdrawals are on top. Initial purchases, reinvestments, and roll-ins are on the bottom.

Account Assets

Yearly total account balances.

If we are in an after-tax account, these figures show up on your tax return. Otherwise, they are tax-free accumulations.

2.2 - TIPS Bonds

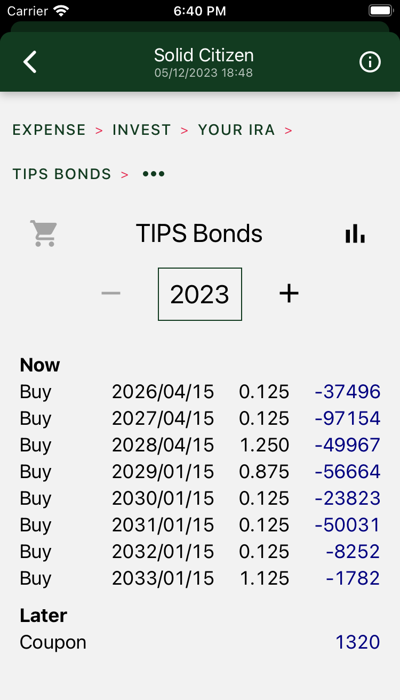

TIPS Inflation Protected Bonds

Hedgematic uses TIPS to to hold the inflation/market risk protected portion of your portfolio.

Bonds are purchased on day zero and held to maturity. They are not subject to interest rate volatility, unlike bond funds where they are all mashed together.

Displayed above is your day zero TIPS shopping list for your IRA account. You see a ladder of bonds,

each of which are redeemed in separate years to give you the guaranteed portion of your yearly expenses. Note that as the term increases, the values decrease. In the out years we can rely more on the typically more profitable S&P to provide more income.

Your broker will list these bonds with treasury bills. Use the “Cusip” id to identify the specific bond. Bond prices vary throughout the day, and Hedgematic does not update them constantly.

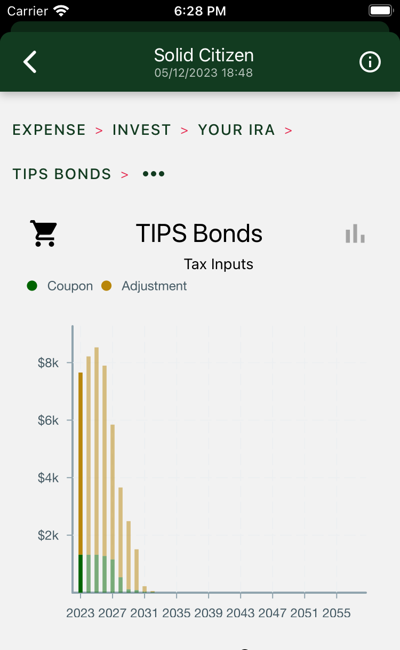

Bonds will pay coupons twice a year. In after-tax accounts, coupons and an inflation adjustment are reported as income.

Bond income and redemptions are drawn from the account at the end of the year and applied to next year’s expenses.

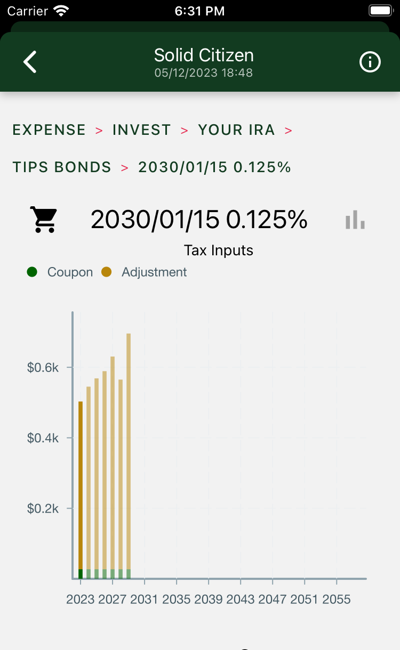

Figures shown in following years are denominated in today’s dollars, and can be relied on with one exception; the inflation adjustment shown is only an estimate and has an effect only in after-tax accounts.

Charts

Three charts are shown. Swipe to view each in turn.

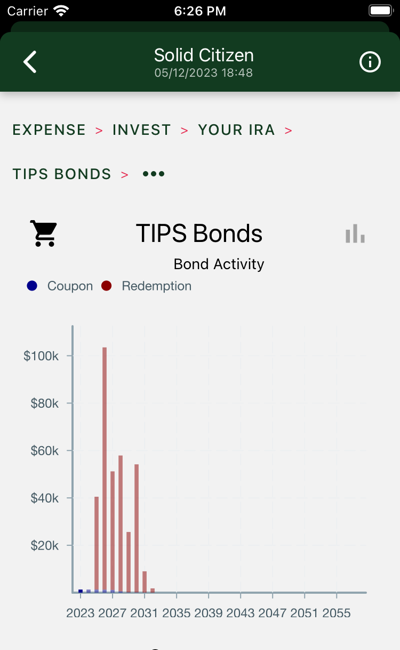

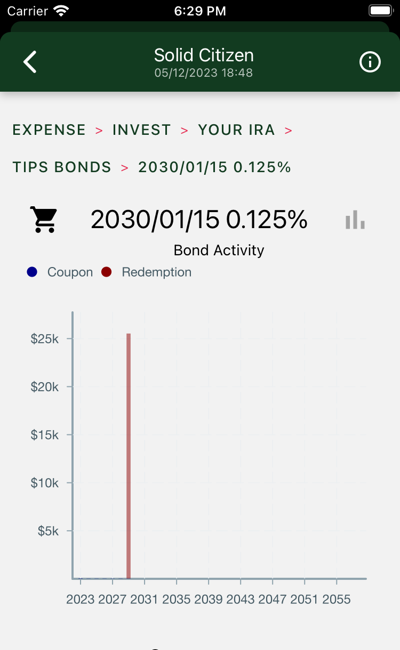

Bond Activity

Tall bars are redemptions. Tiny bars are coupons.

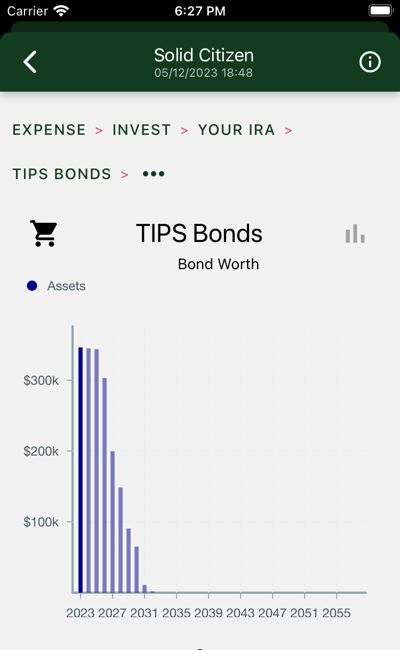

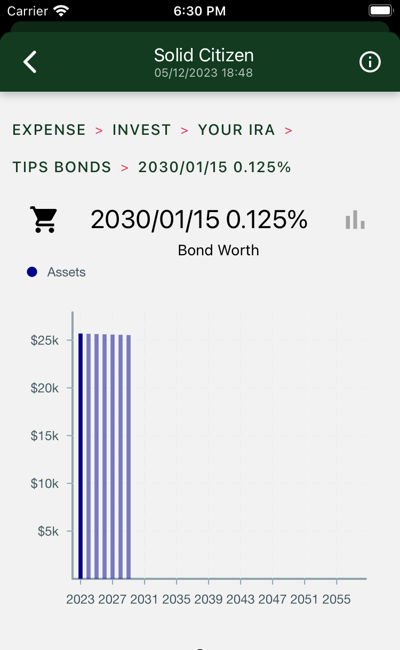

Bond Assets

Total bond value decreases as earlier maturities are redeemed.

If we are in an after-tax account, these figures show up on your tax return. Otherwise, they document tax-free accumulations.

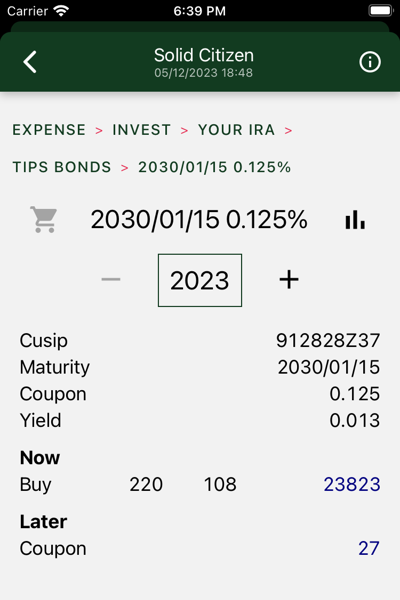

2.2.1 - TIPS Bond

Individual TIPS Inflation Protected Bonds

Display includes the Cusip id for identifying this individual bond issue, as well as disaggregating figures that appear as totals on the parent bond list display.

Charts

Three charts are shown. Swipe to view each in turn.

Bond Activity

See tiny coupons followed by big redemption.

Bond Assets

Present value of bond declines as coupons are paid out.

The coupons are in today’s dollars. Your adjustments will vary.