Your Spouse's Information

Enter some basic demographic data for your spouse

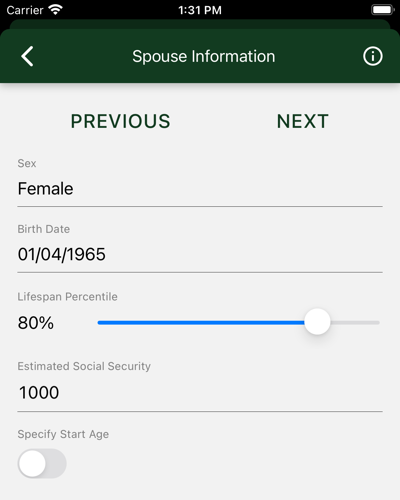

If you selected “married joint” for your tax filing status, you will be shown this form. It looks like the previous page, which can be confusing. Use this form to enter personal data and social security information for your spouse.

- Sex: Male, Female, or Unspecified. Birth Date, Sex, and Lifespan Percentile are used to calculate your lifespan and Social Security payments.

- Birth Date: Your date of birth.

- Lifespan Percentile: A number between 1% and 99%. If you think you will outlive 75% of your High School class, enter 75.

- Estimated SS Check: This is the Social Security “Primary Insurance Amount”, their estimate of what your monthly check will be if you start taking Social Security at your “full retirement age.” If you are old, they send a report with this number every year. If you lost it, go to ssa.gov and use their tool to compute the number. If you have consistently paid the maximum Social Security tax, plug in $3627 (2023 max) and put off that trip to ssa.gov.

- Specify Start Age: Leave this unchecked and Hedgmatic will figure out when to start Social Security to give you your maximum benefit. If you are already on Social Security, or you want to play around and see what different start ages do to your numbers, select this to enter your Social Security start age. When first displayed, the slider shows you your official full retirement age. Click or drag to set it to any age between 62 and 70. If you are already getting Social Security, set the start age to the age you started getting checks. Important: make sure the estimated check amount is the “Primary Insurance Amount” full retirement age figure, which will not be the amount on your monthly check if you started early or late.