This is the multi-page printable view of this section.

Click here to print.

Return to the regular view of this page.

Your Hedgmatic Profile

Hedgematic keeps each of your retirement scenarios in a profile

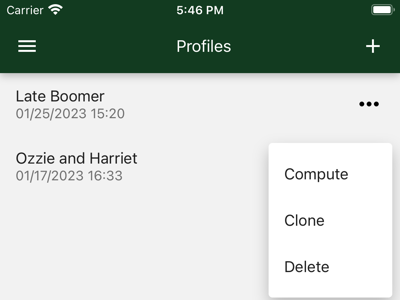

Hedgematic maintains a list of your profiles. You might create several profiles to see the effects of different choices you have.

Create your first Hedgematic profile by pressing the plus sign, proceeding to describe yourself and your retirement position:

- Demographics: e.g. Birthday, age, and sex.

- Social security: Estimated check? Have you started?

- Expenses: After tax, after inflation spending requirements for each year of your retirement.

- Balances: Your assets by account.

Once you create a profile, select the dot menu to access the following actions:

- Compute a complete tax-optimized retirement portfolio, hedged against market risk and inflation. Can I retire today? If not, how much am I short? When do I start social security? What instruments go into my portfolio?

- Clone a profile to create a new profile, based on the existing one. Stack them up against each other. There is no “edit profile” feature." This is so you can repeatedly run scenarios over time and compare the results. Instead of editing, select this option, enter a descriptive name for the new profile variation, and apply your changes to the new copy.

- Delete a profile, and any computed results for it.

If you just tap the profile you get a summary of that profile’s settings.

1 - For Starters

Create a personal profile to submit to Hedgmatic

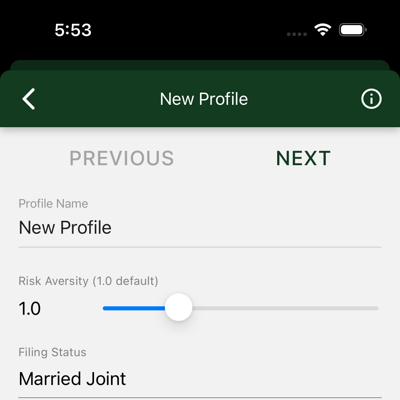

When creating a new profile, Hedgematic guides you through some initial data collection. To get started, you first provide three values.

-

Profile Name is displayed with the profile and any results computed from that profile. It is required and must be unique.

-

Risk Aversity requires some explanation. Your portfolio works like a variable annuity. For the remainder of your life, your portfolio pays you every year. The default value is 1.0. Lower numbers increase the chance that individual years may come up short. Higher values offer more security.

-

Filing Status is your IRS filing status. It is used for two purposes:

- Hedgematic uses this value when tax-optimizing your portfolio.

- If you select ‘married’, Hedgematic will ask for information about your spouse and incorporate it in the analysis.

Buttons at the top of the page are used to navigate through these initial dialogs:

- PREVIOUS takes you to the previous page (if available).

- NEXT takes you to the next page (if available).

- SUBMIT Seen on the last page, saves your new profile and returns to the Profiles page

You can’t click these buttons if there are any errors on the page. Fix them first.

If you click the back arrow, profile creation is cancelled and you are returned to the profile list.

2 - Your Information

Enter some basic demographic data

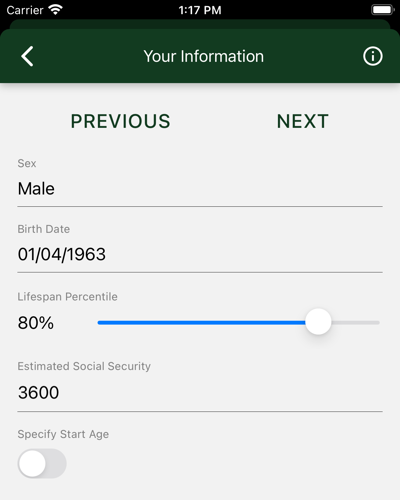

Use this form to enter personal data and social security information.

- Sex: Male, Female, or Unspecified. Birth Date, Sex, and Lifespan Percentile are used to calculate your lifespan and Social Security payments.

- Birth Date: Your date of birth.

- Lifespan Percentile: A number between 1% and 99%. If you think you will outlive 75% of your High School class, enter 75.

- Estimated SS Check: This is the Social Security “Primary Insurance Amount”, their estimate of what your monthly check will be if

you start taking Social Security at your “full retirement age.” If you are old, they send a report with this number every year. If you lost it,

go to ssa.gov and use their tool to compute the number. If you have consistently paid the maximum Social Security tax, plug in $3627 (2023 max) and

put off that trip to ssa.gov.

- Specify Start Age: Leave this unchecked and Hedgmatic will figure out when to start Social Security to give you your maximum benefit. If you

are already on Social Security, or you want to play around and see what different start ages do to your numbers, select this to enter your Social Security start age.

When first displayed, the slider shows you your official full retirement age. Click or drag to set it to any age between 62 and 70.

If you are already getting Social Security, set the start age to the age you started getting checks. Important: make sure the estimated check amount is the

“Primary Insurance Amount” full retirement age figure, which will not be the amount on your monthly check if you started early or late.

3 - Your Spouse's Information

Enter some basic demographic data for your spouse

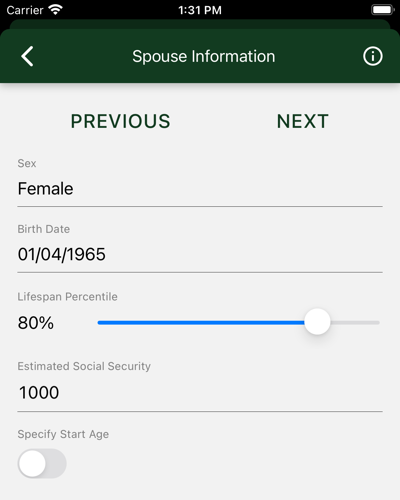

If you selected “married joint” for your tax filing status, you will be shown this form. It looks like the previous page, which can be confusing.

Use this form to enter personal data and social security information for your spouse.

- Sex: Male, Female, or Unspecified. Birth Date, Sex, and Lifespan Percentile are used to calculate your lifespan and Social Security payments.

- Birth Date: Your date of birth.

- Lifespan Percentile: A number between 1% and 99%. If you think you will outlive 75% of your High School class, enter 75.

- Estimated SS Check: This is the Social Security “Primary Insurance Amount”, their estimate of what your monthly check will be if

you start taking Social Security at your “full retirement age.” If you are old, they send a report with this number every year. If you lost it,

go to ssa.gov and use their tool to compute the number. If you have consistently paid the maximum Social Security tax, plug in $3627 (2023 max) and

put off that trip to ssa.gov.

- Specify Start Age: Leave this unchecked and Hedgmatic will figure out when to start Social Security to give you your maximum benefit. If you

are already on Social Security, or you want to play around and see what different start ages do to your numbers, select this to enter your Social Security start age.

When first displayed, the slider shows you your official full retirement age. Click or drag to set it to any age between 62 and 70.

If you are already getting Social Security, set the start age to the age you started getting checks. Important: make sure the estimated check amount is the

“Primary Insurance Amount” full retirement age figure, which will not be the amount on your monthly check if you started early or late.

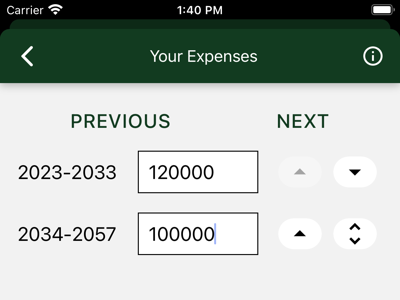

4 - Your Expenses

Enter after-tax, current-dollar income needs for each remaining year of your life

Hedgematic allows you to specify income requirements for each individual year of retirement. These figures should be entered in today’s dollars.

Values should be required actual after-tax disposable income. Hedgematic will optimize taxes over the course of your retirement and give you

results in today’s dollars.

If you need the same amount every year, starting today, just type it in and move on. Hedgematic will tell you when your retirement can start.

If you anticipate different income requirements for upcoming phases of your life, set up multiple intervals and assign needed income to each,

using the buttons at the end of each row to:

- Split the last year off into its own new row.

- Move the last year of an interval down into the next row.

- Move the first year of an interval up into the previous row.

- Remove a one-year interval, by combining it with the previous row.

For example:

- Our illustrated couple have a mortgage that will be paid off in 2033. They split off a second row, pressed the down arrow nine times, and entered dollar figures for each row.

- If you have a target retirement date, use the same approach to start your retirement later. Enter zeros for the years you plan to be working. Any surplus

will be credited to your estate.

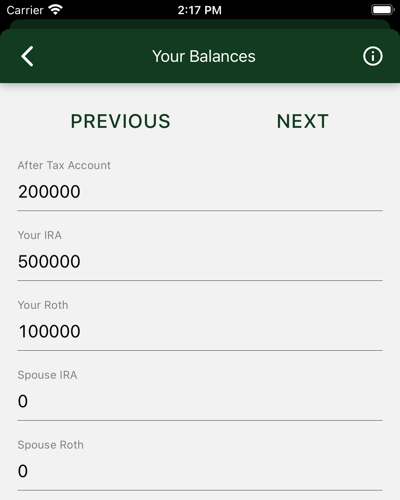

5 - Your Balances

Enter account balances by type of account

List your accounts and their balances. If you have multiple accounts in the following categories, aggregate their balances and enter the total in the appropriate category.

-

After Tax is the balance of your savings that are not deposited in retirement accounts. Include accounts for you and your spouse.

For this and other accounts, leave the entry zero if no balance or no account.

-

Your IRA is the account balance of your IRA or 401K.

-

Spouse’s IRA is your spouse’s IRA or 401K balance.

-

Your Roth is your Roth account balance. Hedgematic will schedule rollovers from your IRA as part of tax optimization. There are some rules about transactions

in a new Roth account, so go ahead and get one, even if you have no deposits to make yet.

-

Spouse’s Roth is your spouse’s Roth balance.

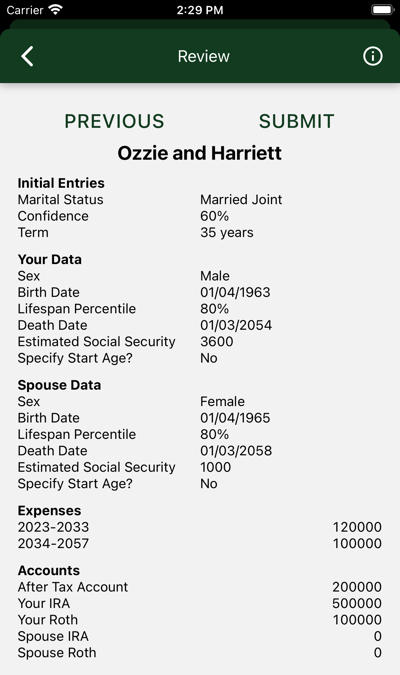

6 - Review

Review and submit your new profile

Review your new profile before pressing SUBMIT to save it.

You may use the PREVIOUS button to go back and fix any errors. (Warning: The back arrow will discard your efforts.)

You will not be able to edit this profile after you submit it. This is so you can compare results over time with the same data.

You can always delete this profile and make another, or clone this profile and make edits in the new profile.