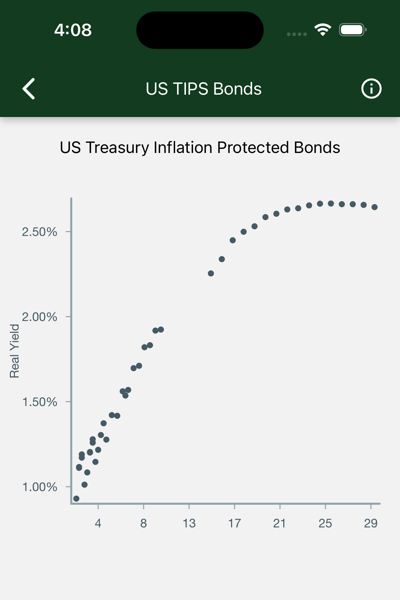

US Treasury Inflation Protected Bonds

Is there an investment I can have 100% confidence in? No, but there is one that gets close.

TIPS (Treasury Inflation Protected Securities) Bonds promise inflation-protected yields, guaranteed by the US government. There are caveats:

- Real yields are low, though competitive after inflation.

- Inflation adjustments are taxed as income.

- You are assuming the US government will continue to pay its bills.

Data

One dot represents an outstanding TIPS bond that matures in a given term. The y-axis displays the current real yield of each issue.

Maturity appears on the x-axis. This is the years to maturity of the bond.

Real Yield appears on the y-axis. The inflation-protected yield. If the real yield is shown as 1.0% and inflation is 2%, compare to a bank account paying 3% on savings.

Discussion

There is a gap of several years where no TIPS are available. These bonds are issued more frequently with more maturities, so that gap will fill in over the next few years.

It is possible to build a completely (with the exception of Treasury default) hedged portfolio consisting solely of TIPS bonds. This comes at great cost though, as you would give up any stock market returns, which have historically outpaced these securities. Where TIPS bonds come into their own though, is as the foundation of a hedged portfolio. By mixing TIPS bonds and stock market instruments, you can create a portfolio that provides a yield, commensurate with your risk tolerance, between that of market returns and the solid floor provided by the TIPS bond.