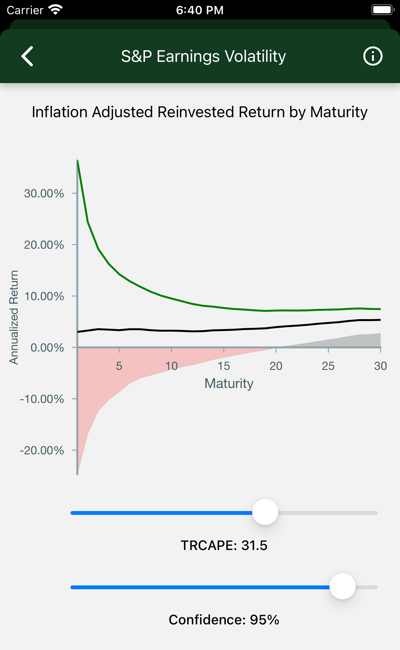

What if we show confidence intervals around modeled S&P Returns?

Data

The chart shows real annualized return by term, given TRCAPE. A slider allows you to set a percentage, called “confidence”. If confidence is 95%, the high and low lines are drawn to include 95% of the expected possibile outcomes. The red zone includes those cases where you lose money. The dark zone shows you where you might be 95% confident that no loss will occur.

-

Maturity appears on the x-axis. This is the number of years an S&P investment is held. As the term increases, you can be more confident that your return falls closeer to the predicted value.

-

Annualized Return appears on the y-axis. This is the expected annualized total after-inflation return of an S&P investment, including reinvested dividends, given a Term and TRCAPE.

-

TRCAPE is adjusted with the slider.

-

Confidence is the confidence percentage. It measures your risk tolerance, with lower values indicating increased tolerance, and higher values indicating relative risk averseness.

Interpretation

- Check out the Maturity effect:

- Short-term bets have wildly varying potential outcomes.

- Long-term investments give you comparatively less risk.

- The chart is initially displayed for today’s TRCAPE. Adjust it and watch:

- If TRCAPE is low, historically, you get out of the red zone much more quickly.

- If TRCAPE is high, you might go 20 years before you reach a tolerable capital loss risk.

- The bottom slider adjusts confidence.

- Move it higher to decrease your chance of unexpected capital loss.

- But keep in mind that unexpected capital gains are also being trimmed.

Background

The results displayed on this page are modeled on data sourced from U.S. Stock Markets 1871-Present and CAPE Ratio.