Combine Yearly Instruments

How do I design a portfolio that covers the length of my retirement?

We have seen (on the previous page) how to construct a combination of S&P and TIPS bonds that yield (with allowance for risk aversity) an optimum inflation-adjusted payout for a single fixed term. Now, the only remaining job is to construct such an instrument for each year of our retirement, and combine them in a single portfolio.

Data

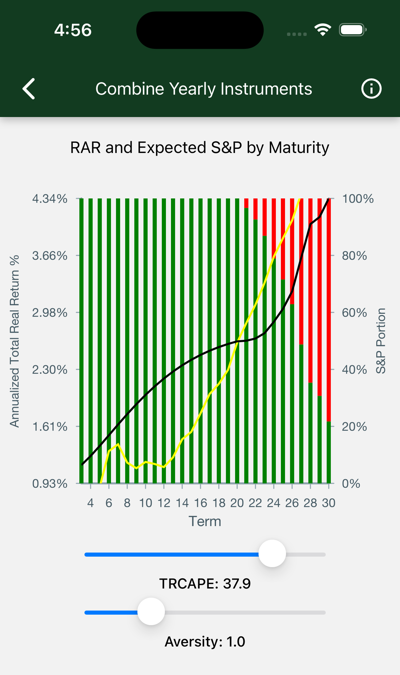

The chart shows expected annualized total after-inflation return of a fixed-term S&P/TIPS mix, with S&P content ranging from 0 to 100%. Use the sliders to see the effect of changes in starting assumptions: aversity, and TRCAPE.

Annualized Total Real Return appears on the left y-axis. Use it to find values for the two lines on the chart. The black line is the risk-adjusted return of your portfolio. The yellow line shows the expected real S&P return. If the black line is under the yellow line, you are all cash. Once they cross, we start adding some S&P and the risk-adjusted yield starts rising more steeply.

Tips Portion marks the right-side y-axis. Use it to guage the height of the left (green) bars, which tell you what percentage of TIPS goes into each year’s payment. The red area is the S&P portion for each year’s withdrawal.

Term is listed on the x-axis. See the yearly portfolio composition for each year, as well as its resulting return.

TRCAPE will have an effect on these predictions. Higher values result in more TIPS.

Aversity 1.0 is the default.

Interpretation

For each year, the bars show the portion of draws that come from market assets, on the top, and inflation-adjusted bonds, on the bottom. For out-years, your portfolio will approach 100% stock.

- The aversity slider changes the composition of your portfolio, as well as the gains for early years.

- Move it right to increase the cash holdings, left to decrease.

- TRCAPE can be adjusted to see how the portfolio would be adjusted for different current market valuations.

With this design, you have determined the source of your yearly draw.

The next step is to add your yearly expenses and assets, then assign draws to accounts to secure a tax-advantaged result. Your final result: Your Hedgematic portfolio.