Wall Streets' Focus on Wealth Unproductive

It’s “an impossible math problem.”1

Alison Schrager, in Wall Street Just Doesn’t Get Retirement, points to confusion and frustration felt by prospective retirees who have no idea whether or not they are on the right track to retirement. She blames the financial industry’s focus on wealth to the exclusion of daily income needs, concluding:

But the goal of retirement finance isn’t your wealth level on a particular day. It is predictable income for the length of your retirement. Getting this basic premise wrong burdens retirees with an enormous and intractable risk.

In the end, she calls on the financial industry to provide better benchmarks and products and promote them in statements and customer communications, regrettably adding that “Making actual changes is just about impossible.”

It just may be that these improvements won’t come from Wall Street. A few years ago, I found myself between jobs. I wondered if I had enough to retire. Being a software developer, I thought “There oughta be an app for that.” There wasn’t an app for that. Digging in, I quickly encountered all the frustrations Alison described in her article. No one told me it was an impossible problem, so I commenced grinding. Years passed.

Hedgematic

Hedgematic is an app that, based on your unique position, constructs a hedged after-tax income stream to cover your individually specified yearly needs for the duration of your retirement. Figures are expressed in today’s dollars and are tax-optimized. Allocations are made via a public algorithm, with sound economic support.

The Recipe

Hedgematic Portfolios

Serves 1 or 2.

Gather ingredients.

- Your birthdays and tax status

- Your lifetime/health percentile rank (Sorry, gotta ask.)

- Current dollar income requirements for each of your remaining years of life.

- Estimated Social Security benefit (plus start age if not “full retirement age”.)

- Your after-tax, IRA, and Roth account balances.

Form one hedge for each remaining year of life:

- Roll out a base of TIPS inflation protected bonds.

- Top with some spicy S&P average. Consult Robert Shiller’s CAPE10 work to get the risk-adjusted proportions just right.

Combine ingredients and hedges in optimizer bowl and process until smooth.

Your Hedgematic Portfolio is Ready to Serve

Start with an amuse bouche: Answers to your biggest questions (benchmarks, if you will):

- Do I have enough to retire?

- If not, what’s the shortfall? When can I actually start?

- If so, what is the size of my estate (in current dollars)?

Once your appetite is stimulated, dig into other delicious offerings:

- Day-zero broker-ready shopping list for each account includes:

- An S&P ETF purchase order summing tranches targeted at each of your following years.

- A ladder of TIPS bonds to drop off yearly inflation protected cash.

- A year-by-year list of all transactions that hit your accounts. This includes the yearly S&P tranche sale, bond redemptions, interest payments, social security benefits, reinvested dividends, and IRA draws and rollovers.

- A tax return for each year. Note that yearly draws include estimated taxes in addition to your after-tax income requirement. Note also that IRA draws and rollovers are scheduled to minimize total taxes over the length of your retirement.

- Lots of charts.

Not to Your Taste?

Too rich? Thin gruel? It’s ok! Adjust your ingredients and make up another batch. With repeated experiments, you will find the combination that’s right for you!

-

Larry Fink, BlackRock CEO. ↩︎

Do You Really Need Ten Times Your Income To Retire?

Background

Two recent stories in the Wall Street Journal:

- In The New Magic Number for Retirement Is $1.46 Million. Here’s What It Tells Us. Anne Tergesen reports on a newly released survey where respondents declared they needed $1.45 million in order to “retire comfortably.” Cited authorites differ on whether this is true, but none are able to provide a confident answer without falling back on crusty “rules of thumb” (Fidelity suggests ten times your income) or disclaimers that “everybody’s situation is unique.”

- In You Don’t Need to Be a Millionaire to Retire Andrew Biggs takes a side. He notes that “the average U.S. adult has saved only $88,400 for retirement,” and points to another survey that found “Of the seniors with more than $10,000 in retirement savings, less than 1% said they were finding it hard to get by, while 93% reported they were doing OK or living comfortably.” He cites failure to account for Social Security’s surprisingly generous benefits, diminishing spending through retirement, and conventional financial planning recommendations as potential explanations for this discrepancy.

Getting a Better Picture of Your Unique Requirements

Hedgematic is an app that, based on your unique position, constructs a hedged after-tax income stream to cover your individually specified yearly needs for the duration of your retirement. Figures are expressed in today’s dollars and are tax-optimized. Allocations are made via a public algorithm, with sound economic support.

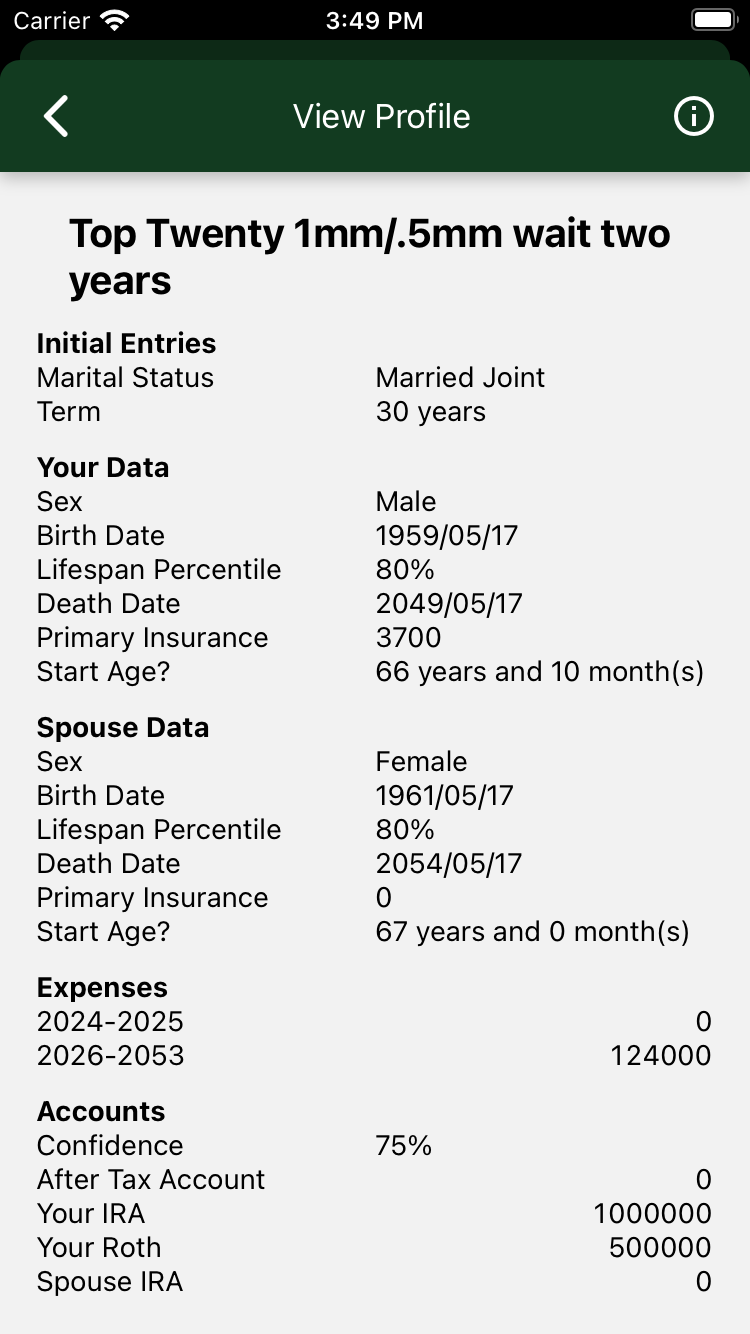

Putting Hedgematic to the Test: The Profile

Let’s see how it works for a household in the 80th percentile. You make $153K per year. Your spouse stayed home. Following Fidelity’s recommendation, you’ve accumulated $1.5 million in assets, a million in an IRA and 500k in a Roth. Your 153K income yields 124K after adjusting for taxes, social security and other deductions. You’ll wait two years to retire and then start drawing 124K. You opt to start Social Security at the default retirement age. Hedgematic computes death dates based on an entered lifespan percentile; in this case you’ve got 30 years. Here’s the profile:

Cut to the Chase

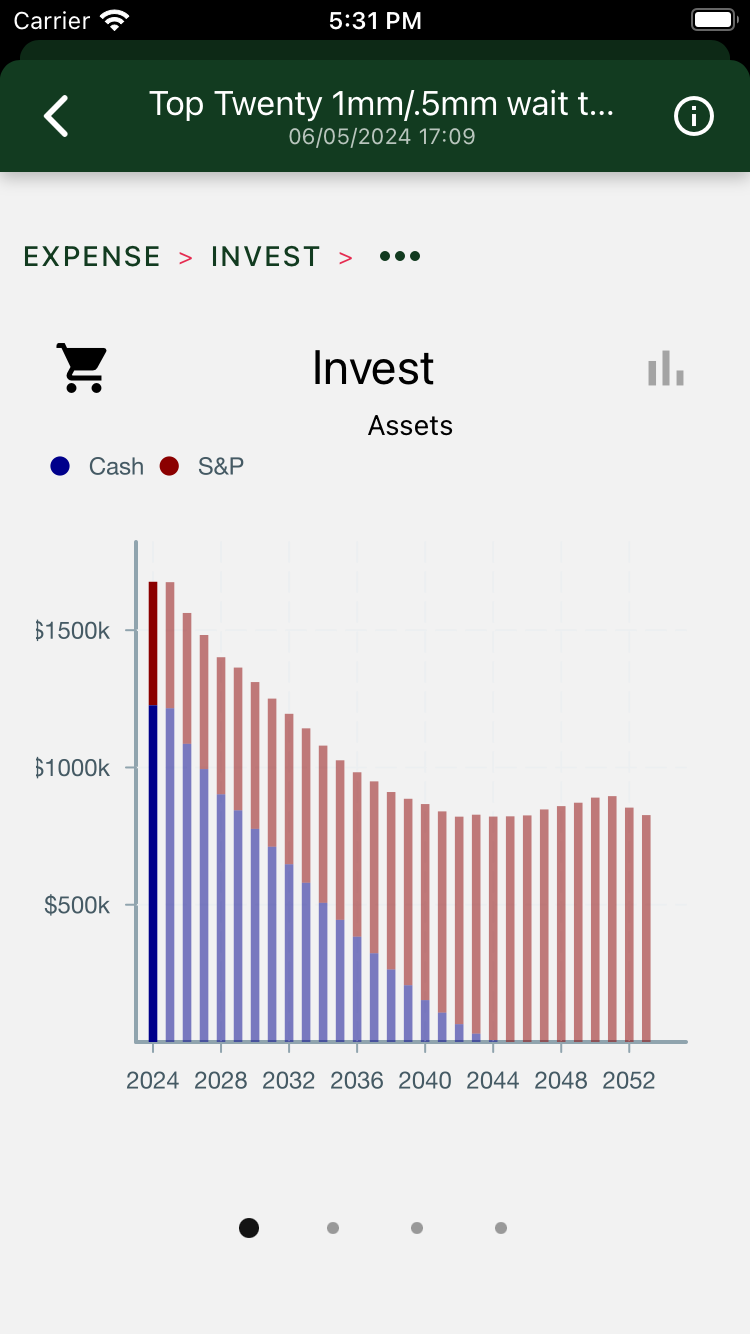

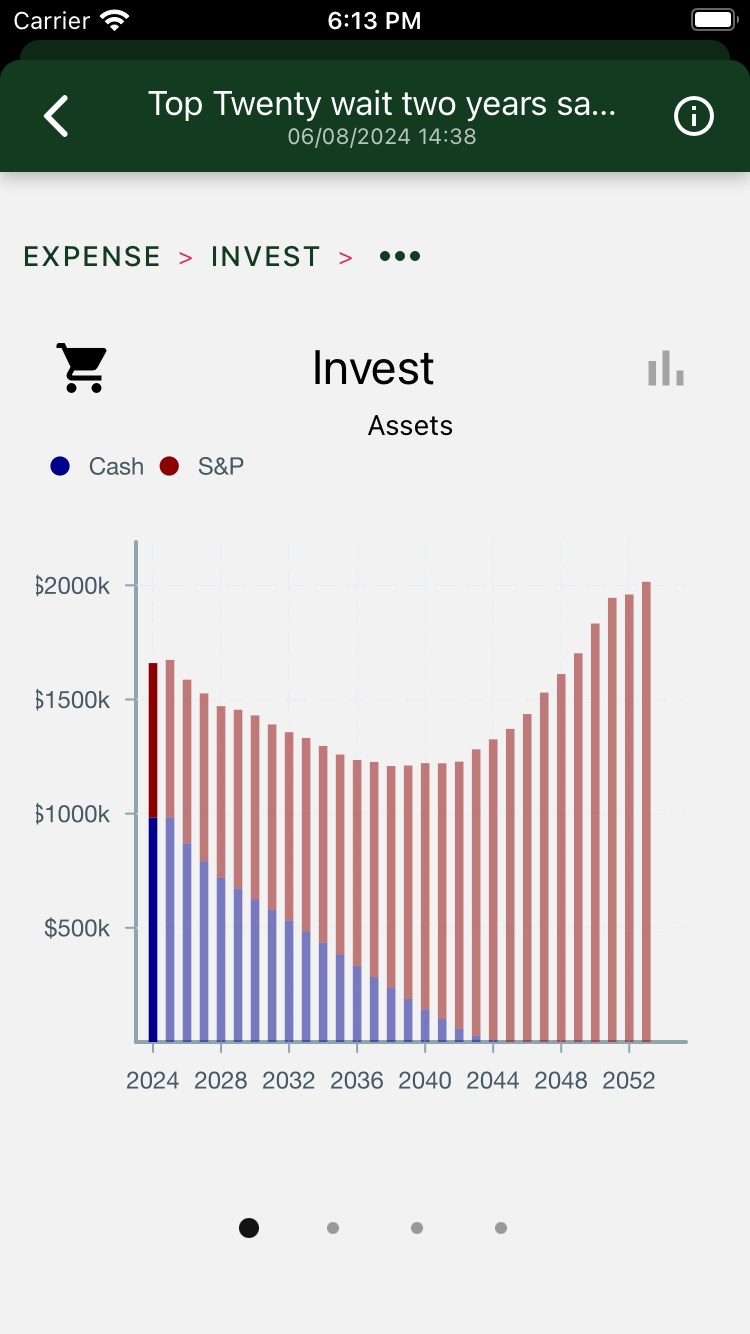

You made it! You leave (an estimated) $850K to your kids. Note that a steady increase was interrupted only by your (timely) death, and attendant cut in Social Security.

Hedgematic split your assets between a ladder of TIPS inflation adjusted bonds (blue) and the S&P (red). When this profile was computed, Shiller’s CAPE was very high, dampening outlook for market gains, and TIPS yields were up. As a consequence, the portfolio starts out heavy in inflation protected cash.

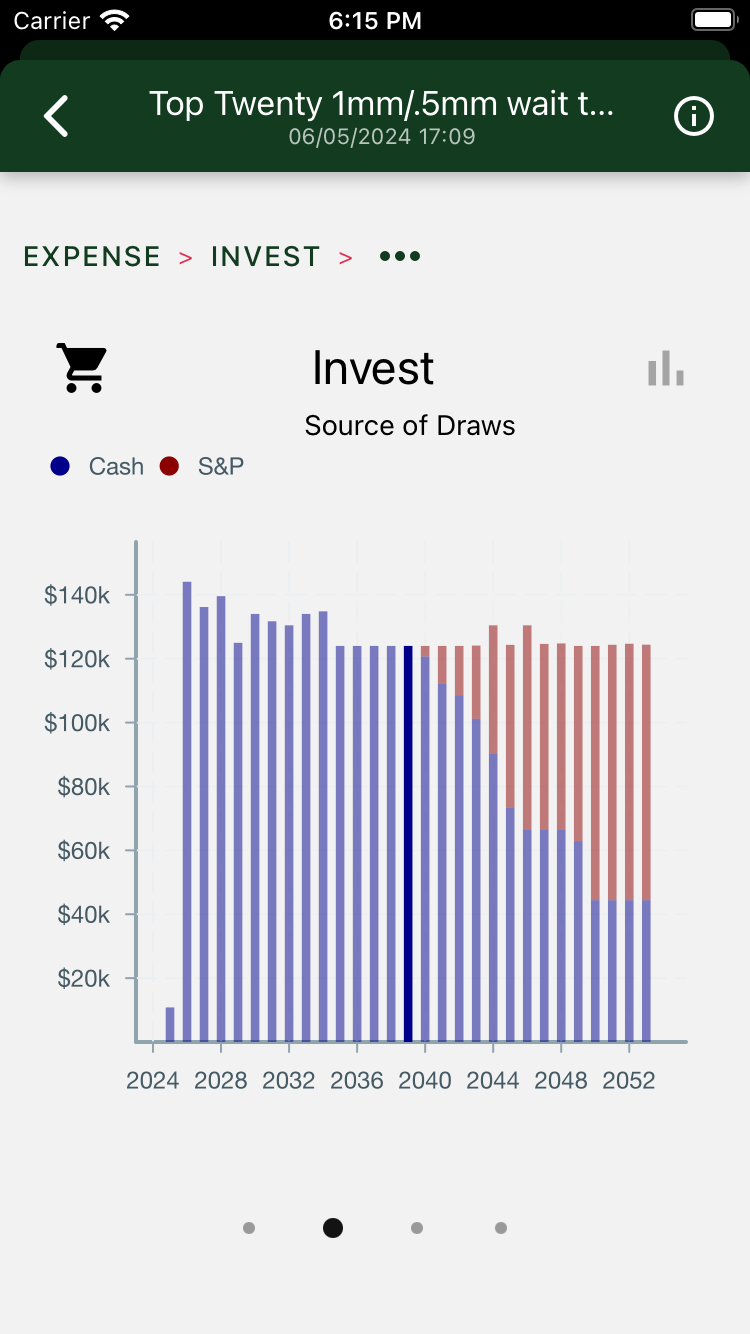

Check Out the Draws

It took you 15 (relatively) risk-free years to start drawing down your S&P!

Note also that some of the draws are larger than the others. Hedgematic provides after-tax income, so the draws include tax obligations.

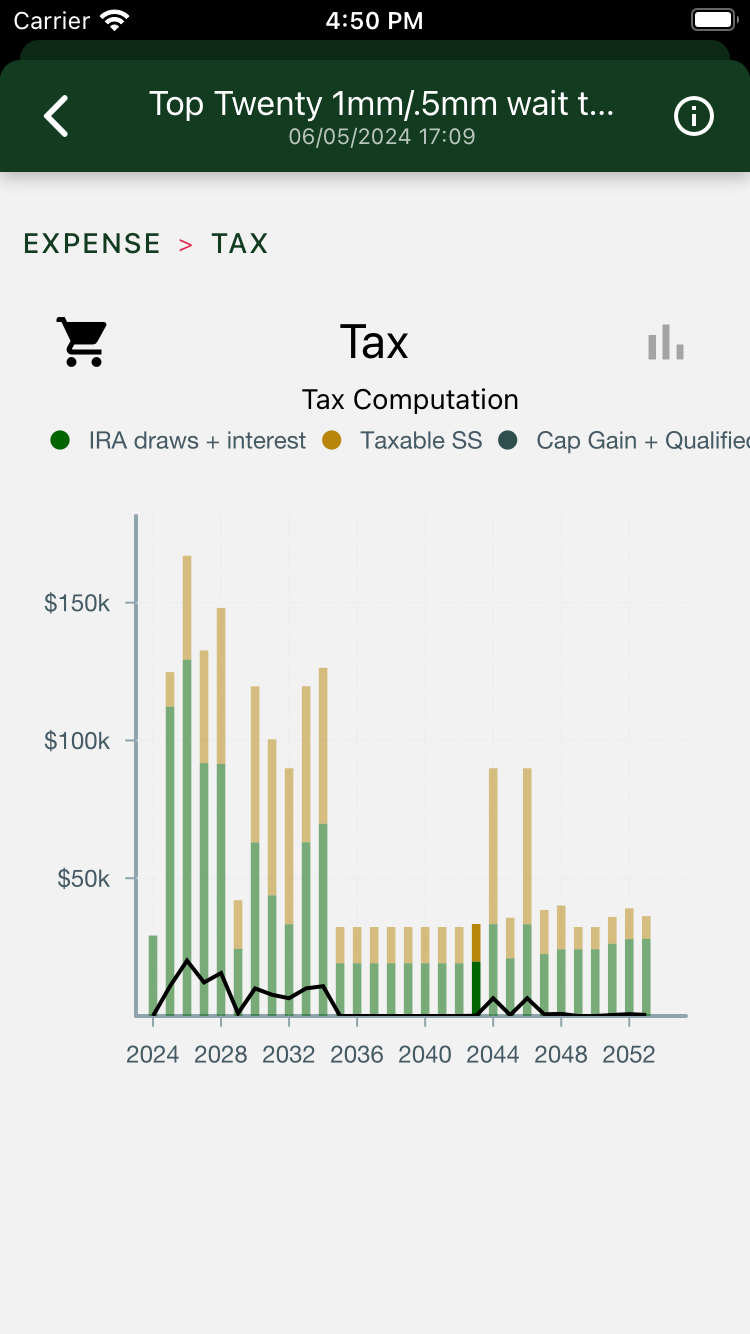

More About Taxes

Here’s the tax returns for your retirement. The black line shows taxes. You pay very little tax.

Note the flat spot in the middle. Every one of those bars hit the standard deduction exactly. Hedgematic seeks the lowest tax rate, then combines draws and rollovers to hit a yearly target.

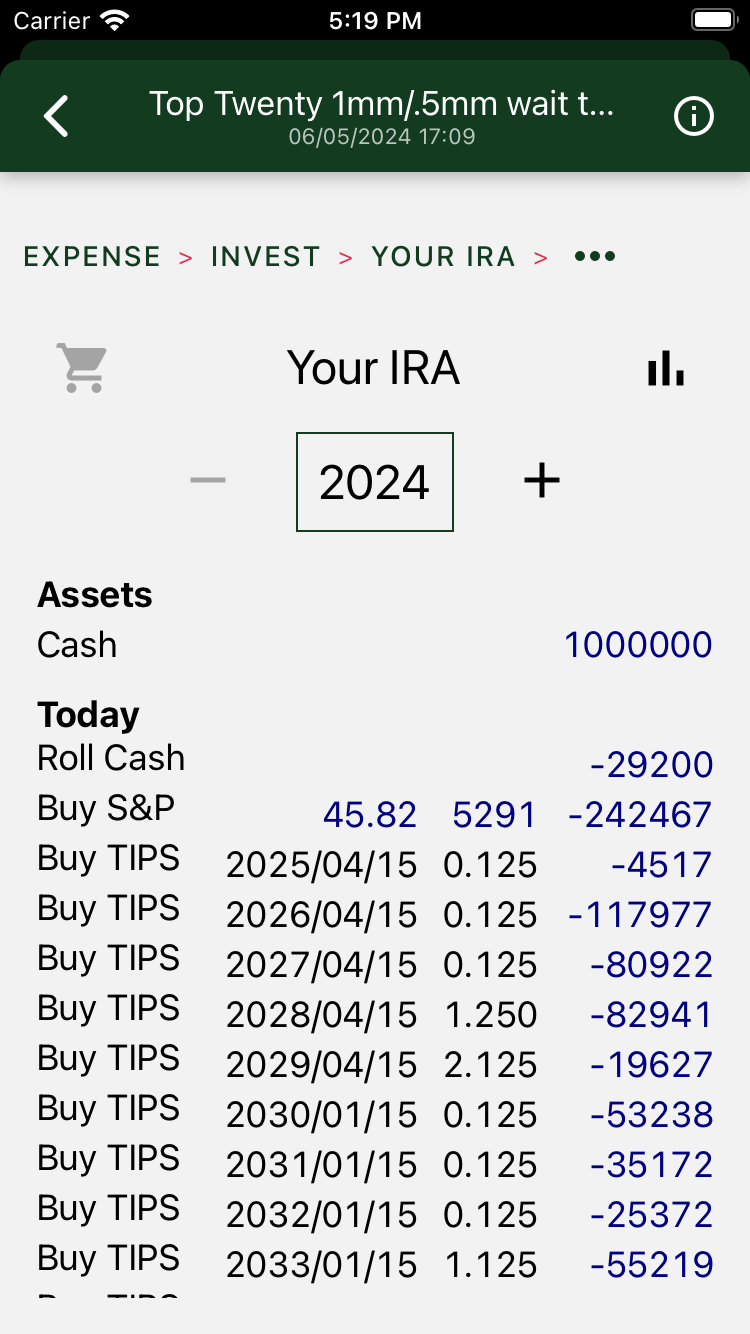

Constructing the Portfolio

Hedgematic gives you year by year transactions for each of your accounts. Here is what you do with your IRA on day one.

You start with a million. Roll 29K to your Roth. Buy 45.82 “S&Ps” at 5291 each for 242K. Spend the remainder on a TIPS bond for each immediately upcoming year. These redemptions, added to your 66K social security (including spousal) will support you well into your retirement while your Roth bubbles along.

Everything is held to maturity, including S&P. That S&P buy actually is the sum of multiple smaller tranches, each targetting a single year. When the year comes, you might be directed to “Sell 14 S&Ps”. You multiply 14 by the current average and sell that much. Your net paycheck is more often than not more than your 124K expectation, but might come in low too. But you never run out.

But Wait, There’s More.

That’s just one scenario. You can vary yearly spend, life expectancy, social security start date, or risk aversity, and recompute.

For example, in the above case, you replaced your after tax income. You think about it and realize you’re not going to be sending that 13K to your IRA every year. Make a new profile and run it.

It turns out that final results are sensitive to starting conditions. Looks like little Jason and Jessica come into a million 2024 dollars each, and that’s before they sell the house. You look at that and think that maybe you could bump up your early retirement travel budget a bit . . .